The much-awaited Telecom Spectrum Auction 2021 is all set to be finally held by the Department of Telecommunications (DoT) this year in the month of March. As we await the release of the notice inviting applications (NIA) expected to be released later this week, that would give insight into the finer details of the Spectrum Auction 2021 we take a deep dive into what’s at stake for Reliance Jio, Bharti Airtel, and Vodafone Idea.

The trio has spectrum holdings in multiple spectrum bands expiring this year with Bharti Airtel and Vodafone Idea having both liberalized and non-liberalized spectrum holdings expiring in multiple circles. Reliance Jio and Reliance Communications meanwhile have liberalized spectrum holdings expiring in the 850 MHz spectrum band in multiple circles.

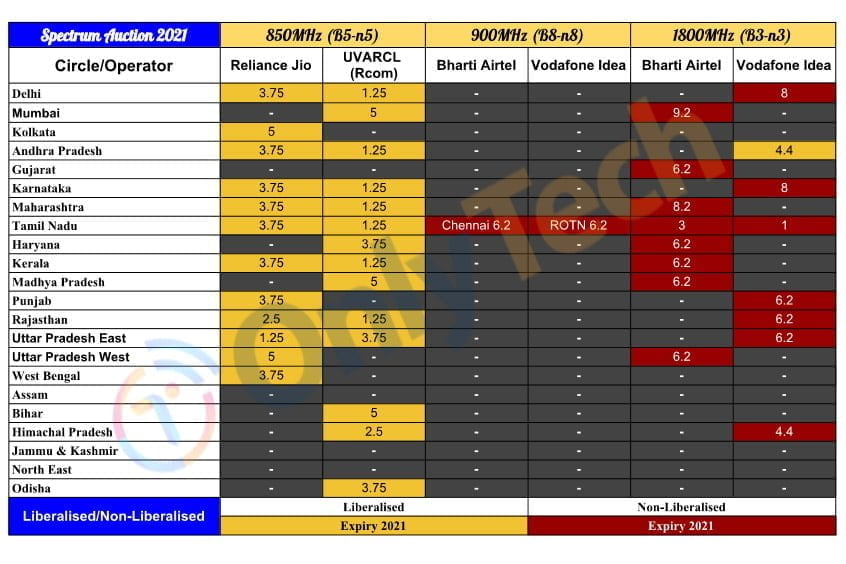

Spectrum Holdings expiring in 2021

Reliance Jio

Reliance Jio and Reliance Communications’ liberalized spectrum holdings in 850 MHz is set to expire this year in quite a lot of circles. Reliance Jio has liberalized spectrum holdings expiring in Delhi, Kolkata, Andhra Pradesh, Karnataka, Maharashtra, Tamil Nadu, Kerala, Punjab, Rajasthan, Uttar Pradesh East, Uttar Pradesh West, and West Bengal amounting to around 43.75 MHz.

Reliance Communications’ liberalized spectrum holdings being used by Reliance Jio through spectrum sharing pact is expiring in Delhi, Mumbai, Andhra Pradesh, Karnataka, Maharashtra, Tamil Nadu, Haryana, Kerala, Madhya Pradesh, Rajasthan, Uttar Pradesh East, Bihar, Himachal Pradesh, and Odisha amounting to around 37.5 MHz.

Bharti Airtel

Bharti Airtel’s spectrum holdings in 900 MHz in Tamil Nadu circle is set to expire this year. The company has 6.2 MHz non-liberalized spectrum in Chennai.

Bharti Airtel’s non-liberalized spectrum holdings in Mumbai, Gujarat, Maharashtra, Tamil Nadu, Haryana, Kerala, Madhya Pradesh, and Uttar Pradesh West are also to set to expire this year in the 1800 MHz band amounting to around 51.4 MHz.

Vodafone Idea

Vodafone Idea’s spectrum holdings in 900 MHz in Tamil Nadu circle is set to expire this year. The company has 6.2 MHz non-liberalized spectrum in the Rest of Tamil Nadu (excluding Chennai).

Vodafone Idea’s non-liberalized spectrum holdings in Delhi, Karnataka, Punjab, Tamil Nadu, Rajasthan, Uttar Pradesh East, and Himachal Pradesh are to set to expire in the 1800 MHz band this year amounting to around 40 MHz. Vodafone Idea also has a 4.4 MHz liberalized spectrum holding in Andhra Pradesh which is expiring this year.

What’s at Stake

The spectrum auction is very crucial for Reliance Jio with its holdings in the 850 MHz band expiring in many circles and those its shares with Reliance Communications. The company already has the smallest spectrum portfolio among private telecom operators making it a must to bid for airwaves lest its services be affected in multiple circles. The company also needs additional spectrum to meet the demands of its 406.36 million subscriber base.

As far as Vodafone Idea is concerned, the circles wherein it’s 1800 MHz spectrum holdings are expiring it has decent spectrum backup given it boasts the largest spectrum holding among all private telecom operators. The company can skip the auction for 1800 MHz or just renew in few select circles given the spectrum backup it boasts. VIL will have to make a decision on the 6.2 MHz non-liberalized spectrum in Tamil Nadu in the 900 MHz band as shifting 2G operations to 1800 MHz band will require significantly more number of towers to be commissioned.

As far as Bharti Airtel is concerned, similar to Vodafone Idea the company has amassed enough 1800 MHz spectrum as backup in circles wherein its spectrum holdings are expiring, thanks to acquisition of Videocon, Telenor and Tata docomo.

The company however has already signalled its plans to fill the gaps in its portfolio with sub GHz spectrum where it is lacking in key circles across Maharashtra, MP, Gujarat, Kerala, Haryana, and UP West. The company will also bid for an incremental capacity spectrum in the 2300 MHz band for existing radios in key cities.

Predictions

The spectrum auction in all likelihood will see Reliance Jio bid extensively and strengthen its spectrum portfolio while renewing key spectrum holdings in the 850 MHz band. Jio may also bid for the highly coveted 700 MHz band as it is flush with investments from the recent stake sales.

Bharti Airtel is likely to bid selectively for sub-GHz and capacity spectrum in the 2300 MHz and possibly give 1800 MHz a miss if it finds the current portfolio enough to meet the demands of its 2G customers.

Vodafone Idea will in all likelihood give this spectrum auction a miss considering the sufficient backup spectrum and refarming of 3G spectrum for 4G services. The operator is also riddled with financial constraints due to pending AGR installments and mounting pressure due to heavy subscriber losses over the past few quarters.