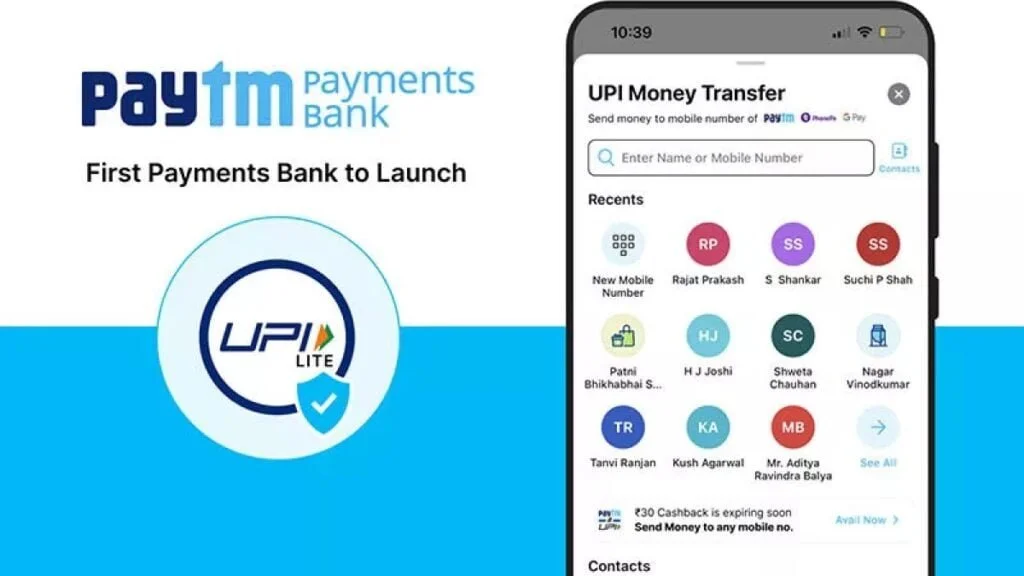

Paytm Payments Bank Limited (PPBL) has launched a new UPI Lite feature to allow users for faster real-time UPI transactions with a single tap using Paytm. UPI Lite is a feature facilitated by the National Payments Corporation of India (NPCI) for multiple small UPI transactions to encourage digital payments across the country. The bank says it is the first Payments Bank to launch the UPI Lite feature.

“We are a leader in UPI as the largest beneficiary bank, acquiring bank and a leading remitter bank. We are excited to be the first to empower Indians with the power of UPI LITE. As per official data from NPCI, half of the everyday UPI transactions in the country are less than Rs. 200 and with UPI LITE, users get superior experience with faster and safer real-time small value payments. We are focussed on driving digital inclusion and the launch of UPI LITE is a big step ahead in that direction,” said Surinder Chawla, MD and CEO of Paytm Payments Bank.

UPI Lite allows users to make small transactions for up to Rs. 200 using the UPI Lite wallet. The wallet limit is up to Rs. 2,000 at any time. However, users can add Rs. 2,000 twice a day, which makes the cumulative daily usage limit to up to Rs. 4,000. Users can also make a large number of small-value UPI payments easily without worrying about bank transaction limits. Further, the UPI Lite de-clutters the bank passbook of small-value transactions, as these payments would now only show in the Paytm balance & history section and not in the bank passbook.

Commenting on the launch, Praveena Rai, COO of NPCI, said, “We are a leader in UPI as the largest beneficiary bank, acquiring bank and a leading remitter bank. We are excited to be the first to empower Indians with the power of UPI LITE. As per official data from NPCI, half of the everyday UPI transactions in the country are less than ₹200 and with UPI LITE, users get superior experience with faster and safer real-time small value payments. We are focussed on driving digital inclusion and the launch of UPI LITE is a big step ahead in that direction.”

According to NPCI’s latest report, Paytm is one of the top 10 remitter banks for UPI transactions, with 389.61 million registered transactions. Paytm Payments Bank Limited is also among the leading issuers and acquirer banks for National Electronics Toll Collection (NETC) FASTag. The bank processed 61.15 million transactions as an issuer Bank and 50.58 million transactions as an acquirer Bank in December 2022.

4 replies

Loading new replies...

Join the full discussion at the OnlyTech Forums →