November proved to be a good month for Airtel in terms of wireless subscriber additions where it continued to boast higher figures than market leader Jio. Airtel seems to have pocketed most of the subscribers porting out of Vi which continued on its downward trajectory with heavy subscriber losses month on month. In the wired broadband segment though Jio had better luck with it dethroning ACT to become the third largest operator.

The overall wireless subscriber base increased marginally by 3.39 million from 1151.81 million at the end of October to 1155.20 million at the end of November 2020. The overall wireline subscriber base increased marginally by 0.08 million from 19.99 million at the end of October to 20.07 million at the end of November 2020.

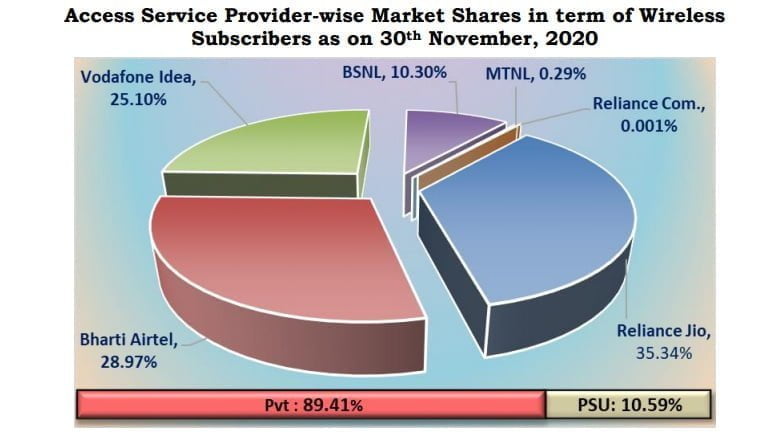

Wireless Subscriber Market share:

As of 30th November, 2020 Reliance Jio is leading with 35.34% wireless subscriber market share which translates to 408.24 million subscribers, Bharti Airtel is at second position with 28.97% market share (334.66 million subscribers), whereas Vodafone Idea comes third with 25.42% market share (289.95 million subscribers). BSNL commands 10.33% (118.98 million) while MTNL commands just 0.29% market share (3.35 million).

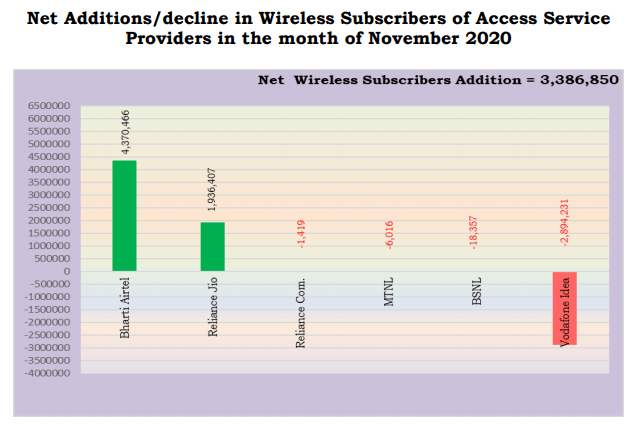

Wireless Subscriber Gain/Loss in November:

Bharti Airtel led the new wireless subscriber addition race in November 2020 with 4.3 million net additions, Reliance Jio was close on its heels with 1.9 million net adds. Vodafone Idea lost over 2.8 million subscribers in November while BSNL lost over 18 thousand wireless subscribers and MTNL lost over 6 thousand.

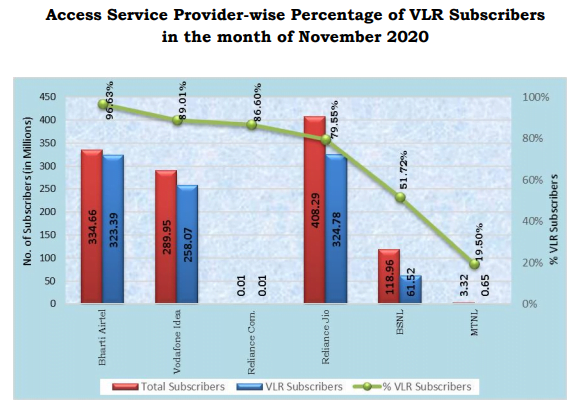

Active subscriber base, VLR data:

Visitor location register (VLR) is an indicator of what percentage of the total subscriber base is comprised of active users. Bharti Airtel leads the race with a VLR score of over 96% which implies it has the lowest inactive user base of 11.27 million, it is followed by Vodafone Idea with a score of over 89% (inactive user base 31.88 million). Reliance Jio has a VLR score of over 79% (inactive user base 83.51 million) whereas BSNL lags behind with a score of 51% (inactive user base 57.44 million).

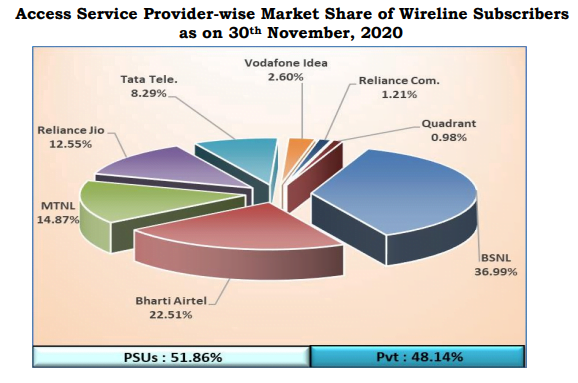

Wireline subscriber market share:

BSNL continues to lead with 36.99% share of the wireline subscriber market share in October 2020, which translates to 7.42 million subscribers. Bharti Airtel commands 22.51% share (4.51 million subscribers). MTNL follows with 14.87% share (2.98 million subscribers). Reliance Jio holds 12.55% share (2.51 million subscribers). Vodafone Idea holds only 2.6% share (0.52 million subscribers).

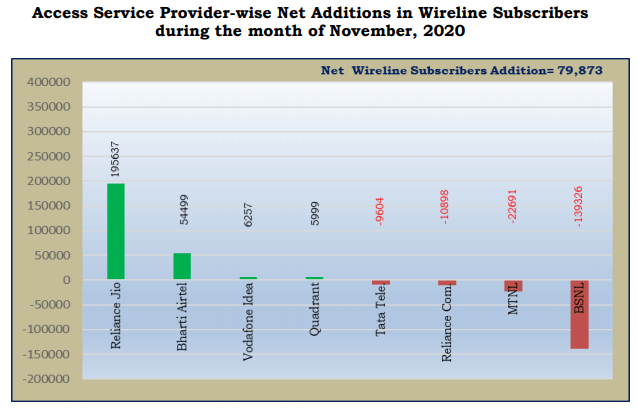

Wireline Subscriber Gain/Loss in November:

Reliance Jio added over 1.9 lakh new wireline connections in November 2020, followed by Bharti Airtel who added over 54 thousand new connections. Vodafone Idea added 6.2 thousand new wireline connections whereas MTNL lost over 22 thousand. BSNL continued the trend of losing subscribers with the loss of over 1.3 lakh connections in November.

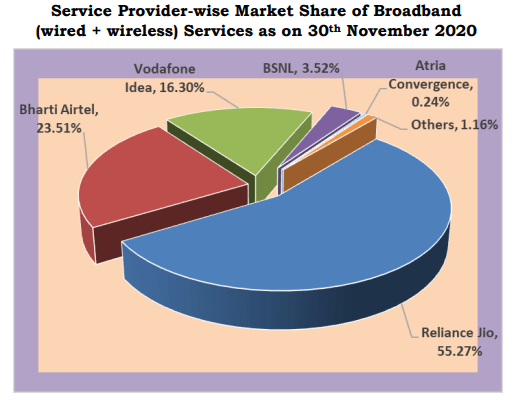

Broadband subscriber market share:

Broadband is considered when the speed offered is higher than 512 Kbps irrespective of it being a wired or wireless connection. As on 30th November 2020, the top five Wired Broadband Service providers by subscriber base were BSNL (7.73 million), Bharti Airtel (2.73 million), Reliance Jio Infocom Ltd (1.87 million), Atria Convergence Technologies (1.76 million), and Hathway Cable & Datacom (1.04 million). The top five Wireless Broadband Service providers were Reliance Jio Infocom Ltd (408.29 million), Bharti Airtel (171.74 million), Vodafone Idea (120.96 million), BSNL (18.40 million) and Tikona Infinet (0.31 million).

No replies yet

Loading new replies...

Join the full discussion at the OnlyTech Forums →