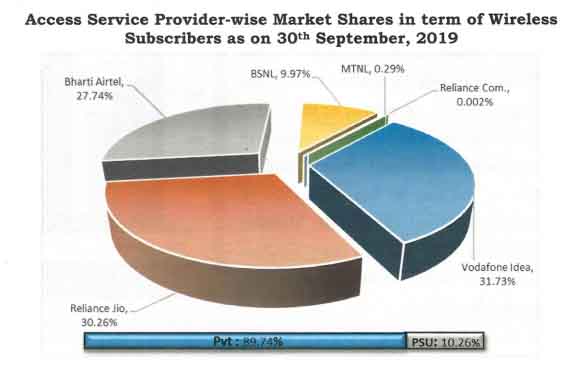

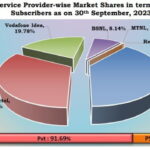

TRAI has released its telecom subscription data for the month of September 2019 which reveals that in the wireless segment Reliance Jio is leading with 6.9 million new subscriber additions followed by BSNL which has added 0.7 million new subscribers while Bharti Airtel has lost 2.3 million subscribers and Vodafone Idea has lost 2.5 million subscribers. with this Vodafone Idea continues to remain the market leader by subscriber market share of 31.73% while Jio retains its second spot with 30.26% market share, followed by Airtel with 27.74% and BSNL trailing behind with 9.97%. With this, the 3 private telcos dominate 90 % of the market whereas the 2 PSUs control only 10%.

Teledensity:

- The number of telephone subscribers in India increased from 1,191.81 million at the end of Aug-19 to 1,195.24 million at the end of Sep-19, thereby showing a monthly growth rate of 0.29%.

- The overall Tele-density in India increased from 90.34 at the end of Aug-19 to 90.52 at the end of Sep-19. The Urban Tele-density declined from 161.54 at the end of Aug-19 to 160.63 at the end of Sep-19. However, Rural Tele-density increased from 56.92 at the end of Aug-19 to 57.59 at the end of Sep-19.

- Delhi service area has a maximum teledensity of 242.13 and the Bihar service area has a minimum teledensity of 59.72 at the end of September 2019.

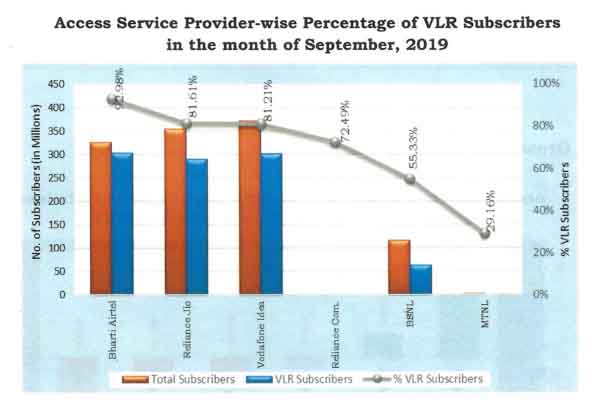

Active wireless subscribers (VLR data)

- Out of the total wireless subscribers (1173.75 million), 960.88 million subscribers were active on the date of peak VLR in the month of Sept-19.

- The proportion of active wireless subscribers was approximately 81.86% of the total wireless subscriber base.

- Bharti Airtel has the maximum proportion (92.98%) of its active wireless subscribers (VLR) as against its total wireless subscribers (HLR) on the date of peak VLR in the month of Sep-19.

Mobile number portability (MNP)

- In the month of September 2019, 5.39 million subscribers submitted their requests for Mobile Number Portability (MNP).

- Out of a total of 5.39 million new requests, 3.38 million requests received from Zone-l (Northern and Western India) and 2.01 million requests received from Zone-II (Southern and Eastern India).

- With this, the cumulative MNP requests increased from 452.26 million at the end of Aug-19 to 457.65 million at the end of Sep-19, since the implementation of MNP.

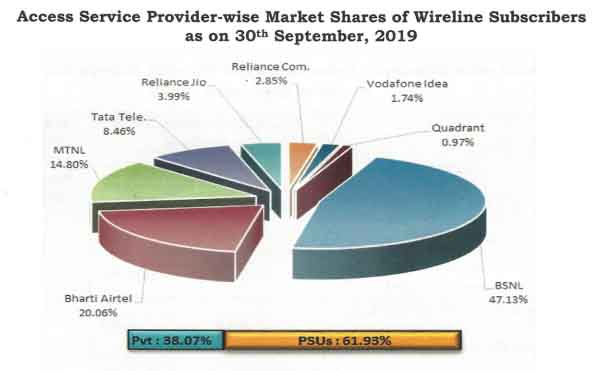

Wireline subscription:

- The total number of wireline subscribers increased from 20.82 million at the end of Aug-19 to 21.49 million at the end of Sep-19.

- Net increase in the wireline subscriber base was 0.67 million with a monthly growth rate of 3.23%.

- Reliance Jio added over 8 lakh wireline subscribers, Airtel added over 6 thousand, Vodafone idea lost over 11 thousand while BSNL lost over 1.4 lakh subscribers.

- BSNL and MTNL, the two PSU access service providers, held 61.93% of the wireline market share as on 30th September 2019.

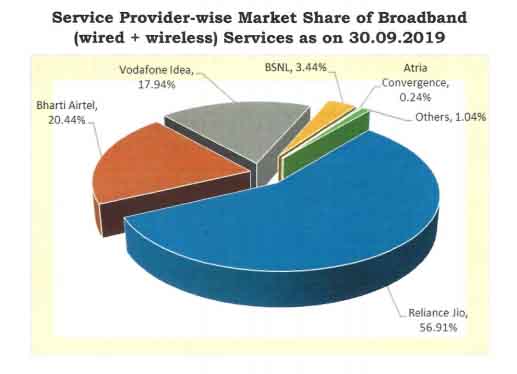

Broadband:

- The number of broadband subscribers increased 615.43 million at the end of Aug-19 to 625.42 million at the end of Sep-19 with a monthly growth rate of 1.62%.

- As on 30th September 2019, the top five Wired Broadband Service providers were BSNL (8.69 million), Bharti Airtel (2.41 million), Atria Convergence Technologies (1.48 million), Hathway Cable & Datacom (0.86 million) and You Broadband (0.75 million).

- As on 30th September 2019, the top five Wireless Broadband Service providers were Reliance Jio Infocom Ltd (355.22 million), Bharti Airtel (125.42 million), Vodafone Idea (112. 17 million), BSNL (12.82 million) and MTNL (0.21 million).

Any info. about Reliance Jio wired user count?

Have mentioned it in the article as 0.8 million (8 lakh). If you want the precise number it is 8,57,461 subscribers.

Wireline means Jio fiber? they’re still adding new customers for Jio fiber

Yes Jio fiber is counted in wireline. Jio is converting the preview customers into paying ones and reporting them as new subscribers and also adding fresh subscribers in areas where there is feasibility.