Reliance Jio, India’s largest operator by subscriber and revenue market share has seen a sharp decline in the new wireless subscriber additions in the month of December 2019 on account of tariff hike which came into effect earlier that month. The operator added only 82,308 new subscribers as opposed to 5.6 million in November.

The effect is also on account of existing 3-month validity pack subscribers porting out of the network post validity expiry on account of off-net calls becoming chargeable in October 2019, as the number of port out subscribers also negates the number of new additions.

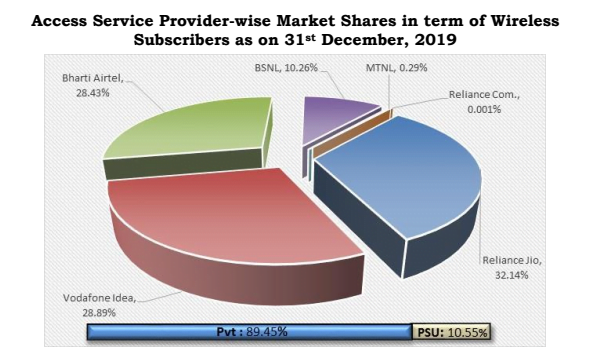

Wireless Subscriber Market share:

As of 31st December 2019 Reliance Jio is leading with 32.14% market share which translates to 370 million subscribers, Vodafone Idea is at second position with 28.89% market share (332.6 million subscribers), whereas Bharti Airtel comes third with 28.43% market share (327.29 million subscribers). BSNL commands 10.26% while MTNL commands just 0.29% market share.

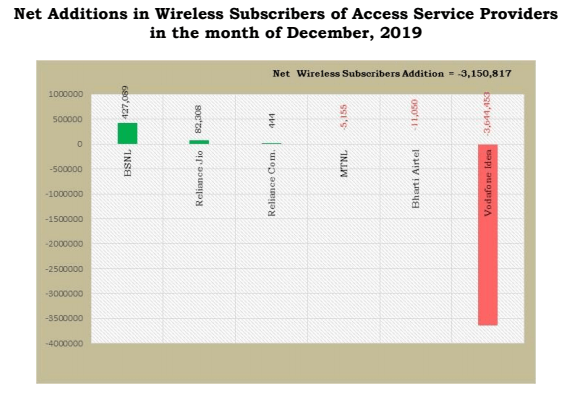

Net Subscriber Gain/Loss in December:

BSNL was leading with 0.4 million new subscriber additions followed by Jio with 82 thousand new subscriber additions. Bharti Airtel lost just over 11 thousand subscribers whereas Vodafone Idea lost a staggering 3.6 million subscribers, largely on account of secondary sims being deactivated after users moving to single sim usage pattern post tariff hikes.

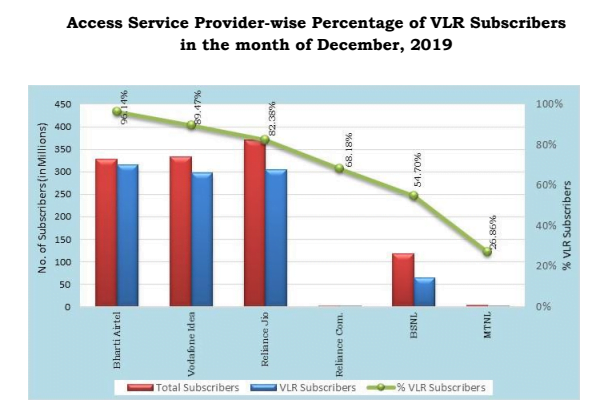

Active subscriber base, VLR data:

Bharti Airtel leads the race in VLR (Visitor location register) numbers with over 96% of its userbase being active, it is closely followed by Vodafone Idea with over 89% userbase being active, Reliance Jio has over 82% active userbase whereas BSNL lags behind with only 54% of its total userbase being active.

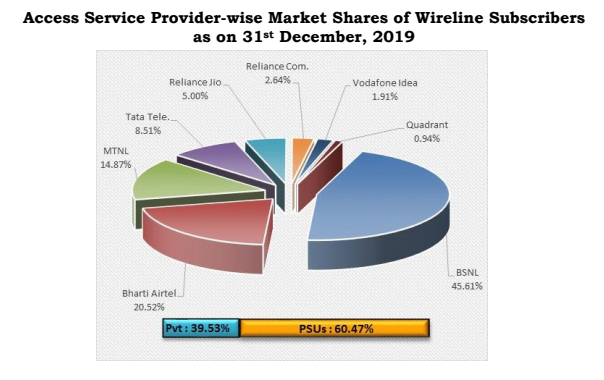

Wireline subscriber market share:

The PSU operators BSNL and MTNL combined still dominate a lion’s share of the wireline telephony market with their combined share being 60.47% whereas that of all private operators put together is 39.53% where Bharti Airtel leads the race with 20.52% and newcomer Reliance Jio who recently launched its Jio fiber commercially, now commands 5% of the wireline customer market share.

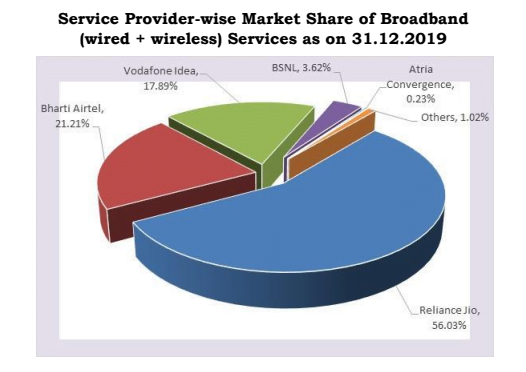

Broadband subscriber market share:

Broadband is considered when the speed offered is higher than 512 Kbps irrespective of it being a wired or wireless connection. When considering the combined broadband market share, Reliance Jio leads with 56.03% market share followed by Bharti Airtel at 21.21% and Vodafone Idea at 17.89% whereas BSNL trails behind with only 3.62% market share.

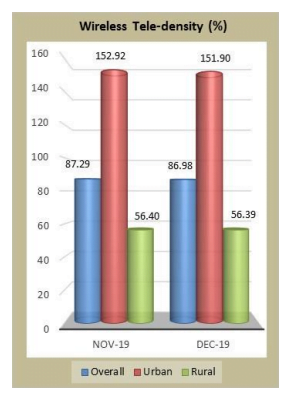

Overall wireless teledensity:

The Wireless Tele-density in India declined from 87.29 at the end of Nov-19 to 86.98 at the end of Dec-19. The Urban Wireless Tele-density declined from 152.92 at the end of Nov-19 to 151.90 at the end of Dec-19 and Rural Wireless Tele-density also declined from 56.40 to 56.39 during the same period. The share of urban and rural wireless subscribers in the total number of wireless subscribers was 55.93% and 44.07% respectively at the end of Dec-19.