The telecom regulator has released the subscription details of operators for the month of June 2022. Reliance Jio ended the second quarter with a strong addition of 4.22 million wireless and 0.2 million wireline subscribers, stealing a march over the other operators in both segments. This also indicates that Jio has completed the cleanup of low-value inactive connections and is now showing healthy new subscriber additions on the back of an expanding smartphone user base.

The overall wireless subscriber base increased marginally by 1.89 million from 1145.50 million at the end of May to 1147.39 million at the end of June 2022. The overall wireline subscriber base increased marginally by 0.34 million from 25.23 million at the end of May to 25.57 million at the end of June 2022.

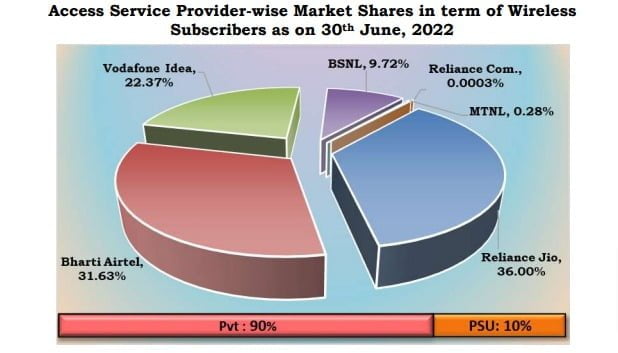

Wireless Subscriber Market share:

As of 30th June 2022, Reliance Jio is leading with 36% wireless subscriber market share which translates to 413.01 million subscribers, Bharti Airtel is at second position with 31.63% market share (362.97 million subscribers), whereas Vodafone Idea comes third with 22.37% market share (256.65 million subscribers). BSNL commands 9.72% (111.52 million) while MTNL commands just 0.28% market share (3.24 million).

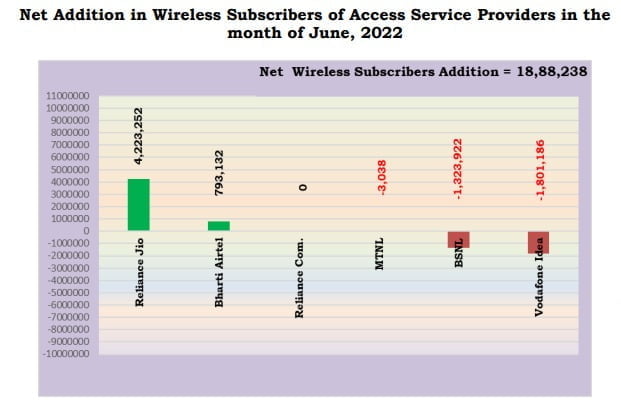

Wireless Subscriber Gain/Loss in June:

Reliance Jio reported a gross addition of 4.22 million subscribers, Bharti Airtel added over 0.79 million wireless subscribers. Vodafone Idea continued its subscriber loss streak with a 1.8 million net loss in June. BSNL lost over 1.3 million wireless subscribers while MTNL lost over 3 thousand.

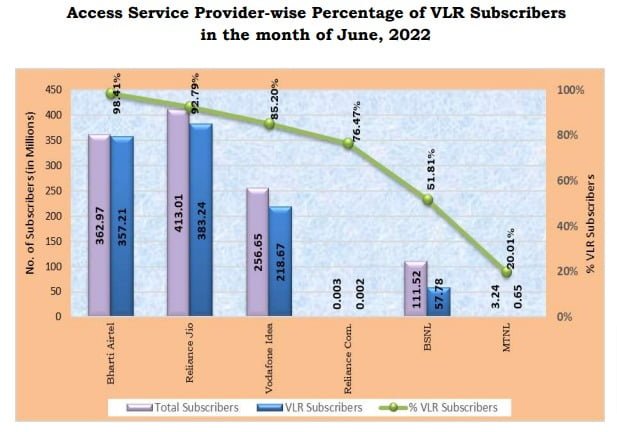

Active subscriber base, VLR data:

Visitor location register (VLR) is an indicator of what percentage of the total subscriber base is comprised of active users. Bharti Airtel leads the race with a VLR score of over 98% and has the lowest inactive user base of 5.76 million, it is followed by Reliance Jio with a score of nearly 93% (inactive user base 29.77 million). Vodafone Idea has a VLR score of 85% (inactive user base 37.98 million), whereas BSNL lags behind with a score of nearly 52% (inactive user base 53.74 million) and MTNL finishes last with a VLR score of 20% (inactive user base 2.59 million).

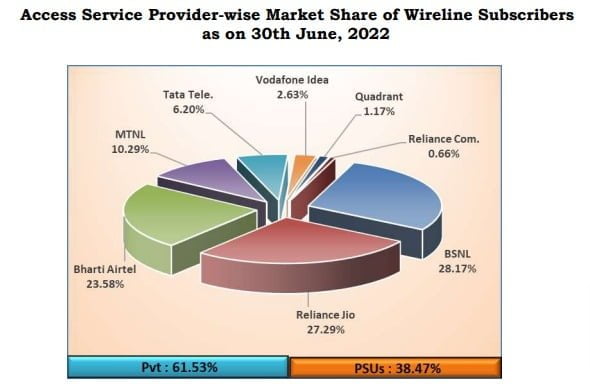

Wireline subscriber market share:

Private operators (read Jio and Airtel) continued to reclaim the market dominance in this segment from PSU operator BSNL which had for long enjoyed the supreme position due to lack of competition from private operators. BSNL has a marginal lead over Jio with a 28.17% share of the wireline subscriber market share in June 2022, which translates to 7.2 million subscribers. Reliance Jio at the second spot commands a 27.29% share (6.97 million subscribers). Bharti Airtel retains the third position with a 23.58% market share (6.02 million). MTNL follows at the fourth spot with a 10.29% share (2.63 million subscribers). Tata Tele holds 6.2% share (1.58 million subscribers).

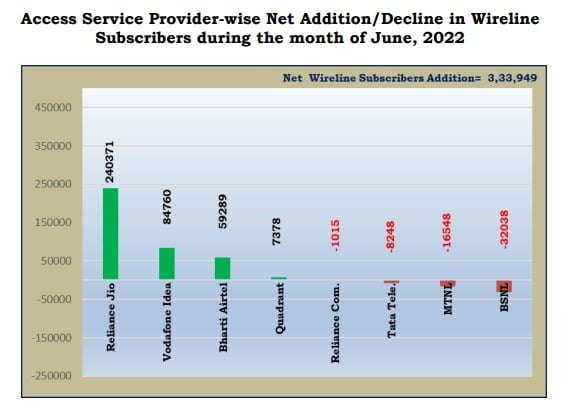

Wireline Subscriber Gain/Loss in June:

Reliance Jio added over 2.4 lakh new wireline connections in June 2022, followed by Vodafone Idea which added over 84 thousand new connections. Bharti Airtel added over 59 thousand wireline subscribers. Tata Tele lost over 8 thousand, whereas MTNL lost over 16 thousand. BSNL continued the trend of losing subscribers with the loss of over 32 thousand connections in June.

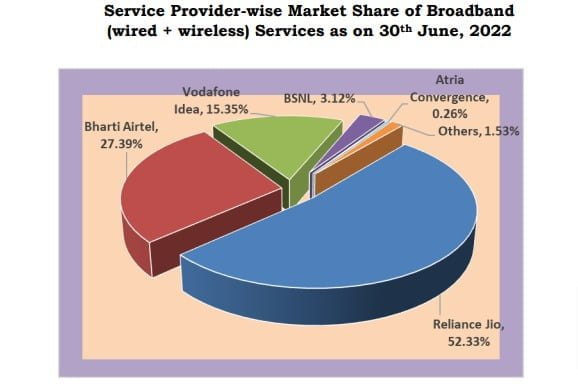

Broadband subscriber market share:

Broadband is considered when the speed offered is higher than 512 Kbps irrespective of it being a wired or wireless connection. As on 30th June 2022, the top five Wired Broadband Service providers by subscriber base were Reliance Jio (6.16 million), Bharti Airtel (4.85 million), BSNL (3.84 million), Atria Convergence Technologies (2.11 million), and Hathway Cable & Datacom (1.11 million). The top five Wireless Broadband Service providers were Reliance Jio Infocom Ltd (413.01 million), Bharti Airtel (214.56 million), Vodafone Idea (122.95 million), BSNL (21.18 million) and Intech Online (0.22 million).

Jio has been leading subscribers additions over competition both in (mobile & fiber )from last few months.

It proves that – jio slight discount pricing over Airtel & vi is working in Jio favour. Slowly jio is improving lead over Airtel with higher monthly subscriber additions.

At the same time – Airtel positioning of itself as a premium operator over jio is fading & in actual it is a marketing gimmick. They are gaining less subscribers from Vi against Jio. At present it is fine for Airtel as they are slowly adding because of vi but

In future it will be difficult for Airtel to cover back jio lead.

It will be interesting to see 5g pricing of Airtel & jio.

Jio cannot handle so much of load on 5G. 4G will become suddenly empty and Jio will have to deploy band 40 for 4G immediately. Also Jio needs band 3 20Mhz PAN India. I hope DoT releases spectrum from this band and Jio buys it. Otherwise its not sustainable for Jio to provide quality services for all. Many people who have moved from Vi to Jio will move back to Airtel and that too postpaid, which is good thing for Airtel. In 5G, postpaid will rule post 2025. Till 2025,you should focus on investing in network rather than revenues. This strategy has worked for Airtel between 2018-2021. Now let’s see. What happens. Interesting times ahead. I see people joining Vi again in big numbers once they launch 5G.

@esmail TRAI don’tshow railwire subscriber. Railwire is available in almostevery where places where jio or airtel is not available.

Even so, the subscriber numbers aren’t large enough for it to be listed separately, it gets listed under others. If they manege to get more subscribers than Hathway then they will be listed.