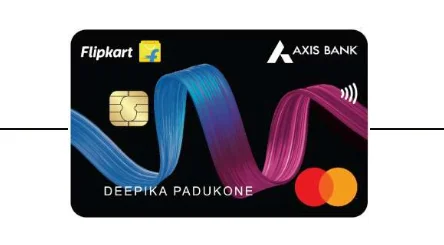

Flipkart has launched its first Co-Branded Credit Card in partnership with Axis Bank and Mastercard. This Flipkart-Axis Bank Credit Card will be available only to select users in July and it will expand to everyone in the upcoming weeks. Here are all details of this newly launched Credit Card.

Welcome Benefits –

- Rs. 500 worth Flipkart vouchers on your first transaction anywhere with your Flipkart Axis Bank credit card.

- 6 months complimentary Gaana subscription for all Flipkart Axis Bank credit cardholders.

- Rs. 500 off on domestic hotel on Goibibo a minimum booking of Rs. 2,000. Using coupon: GIAXISFK.

- Rs. 500 off on domestic hotel on Makemytrip a minimum booking of Rs. 2,000. Using coupon: MMTAXISFK.

- 15% cashback up to Rs. 500 on your first transaction on Myntra using your Flipkart Axis Bank credit card.

- 20% instant discount up to Rs. 400 for new Urban Clap customers. Using coupon code: AXISFLIPKART.

Additional Benefits –

- 20 percent discount at over 4,000 restaurants in India.

- 4 Complimentary Lounge visits per year to selected airport lounges throughout India.

- 1% Fuel surcharge waiver up to Rs. 500 per month at any fuel station in India.

Unlimited Cashback Offers –

- 5% unlimited cashback on Flipkart, Myntra, and 2GUD

- 4% unlimited cashback on MakeMyTrip, Goibibo, Uber, PVR, Curefit, and UrbanClap

- 1.5% unlimited cashback on purchases made at all other retailers

Charges –

| Joining fee | Rs. 500 |

|---|---|

| Annual Fee | 1st year: Nil 2nd year: Rs. 500 |

| Add-on card joining fee | Nil |

| Add-on card annual fee | Nil |

| Card replacement fee (lost or stolen or re-issue) | Waived |

| Cash payment fee | Rs.100 |

| Outstation cheque fee | Waived |

| Mobile alerts for transactions | Free |

| Hotlisting charges | Nil |

| Balance enquiry charges | Waived |

| Finance charges (Retail purchases and cash) | 3.4% per month (49.36% per annum) |

| Cash withdrawal fees | 2.5% (Min. Rs. 500) of the cash amount |

| Overdue Penalty or Late payment fees | Nil if total payment Due is up to Rs. 100 Rs. 100 if the total payment due is between Rs. 101 – Rs. 300 Rs. 300 if the total payment due is between Rs. 301 – Rs. 1,000 Rs. 500 if the total payment due is between Rs. 1,001 – Rs. 5,000 Rs. 600 if the total payment due is between Rs. 5,001 – Rs. 10,000 Rs. 700 if the total payment due is Rs. 10,001 and above |

| Over limit penalty | 3% of the over-limit amount (Min Rs. 500) |

| Cheque return or dishonour fee or auto-debit reversal | 2% of the payment amount subject to min. Rs. 450 |

| Surcharge on purchase or cancellation of railway tickets | As prescribed by IRCTC/Indian Railways |

| Foreign currency transaction fee | 3.5% of the transaction value |

Eligibility –

- Primary cardholder should be between the age of 18 and 70 years

- Add-on cardholder should be over 15 years

- He must be Resident of India or a Non-Resident Indian

Documents Required –

- PAN card photocopy or Form 60

- Residence proof

- Identity proof

- A colour photograph

- Proof of income such as the latest payslip or Form 16 or IT return copy.