rahul1117kumar

Contributor

- Joined

- 21 Jun 2013

- Messages

- 10,365

- Reaction score

- 11,057

In order to link PAN and Aadhaar cards, tax payers have to first register on the Income tax e-Filing portal. Once they have done so, they are to follow the steps outlined below:

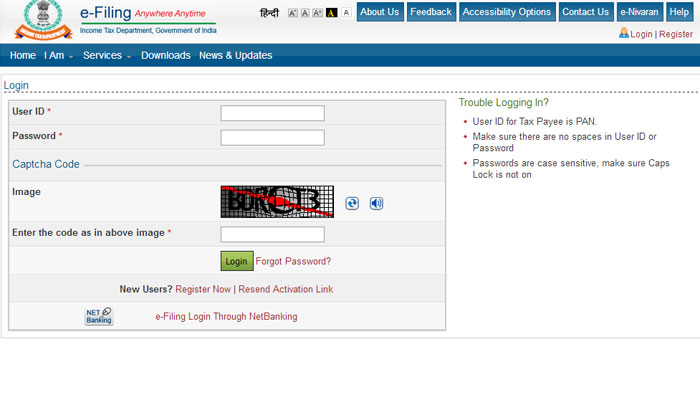

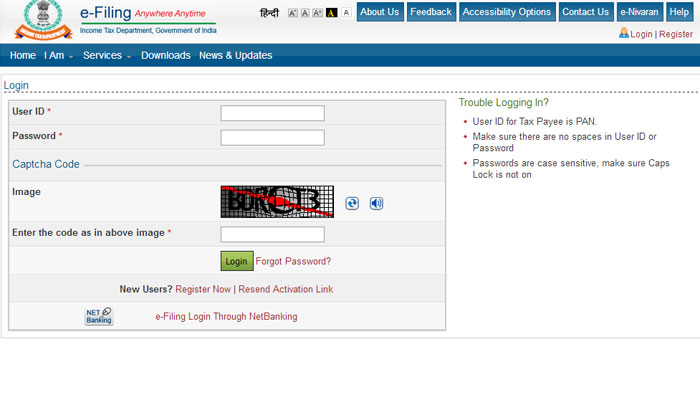

Log in to the e-Filing portal of the Income Tax Department by entering the log-in ID, password and date of birth

After punching in the details, you will also have to feed in a code

On logging in to the site, a pop up window will appear, prompting you to link your PAN card with Aadhaar card

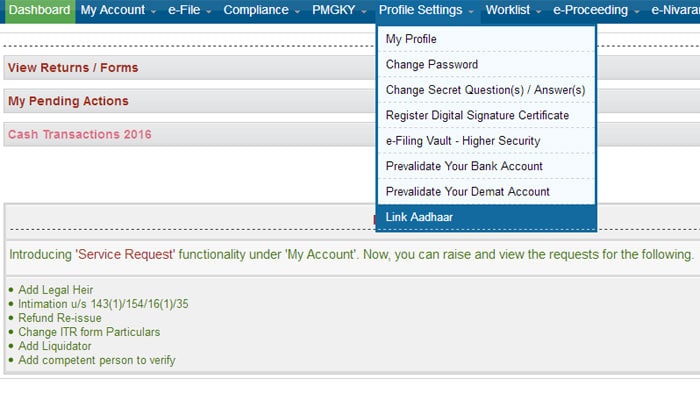

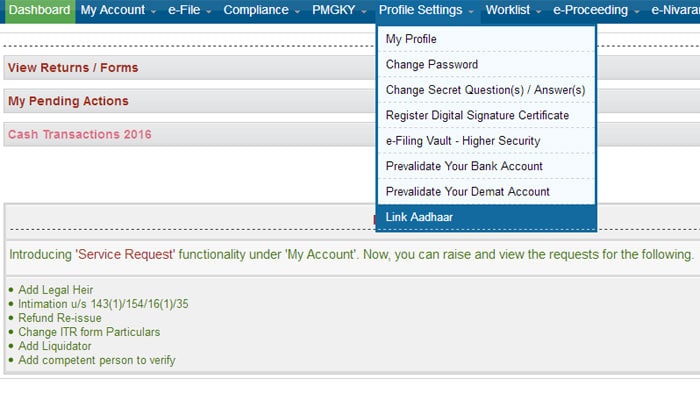

If not, you can go to Profile setting and opt the “Link Adhaar” button

Punch in the details such as name, date of birth and gender. It will be already mentioned by you during registration on the e-Filing portal

Verify the details on screen with the ones mentioned on your Aadhaar card

If the details match, enter your Aadhaar card number and click on the “link now” button

You will get the message that your Aadhaar card has been successfully linked to your PAN card

Know how to link your PAN card with Aadhaar card – Here is the step by step explanation | Zee News

Log in to the e-Filing portal of the Income Tax Department by entering the log-in ID, password and date of birth

After punching in the details, you will also have to feed in a code

On logging in to the site, a pop up window will appear, prompting you to link your PAN card with Aadhaar card

If not, you can go to Profile setting and opt the “Link Adhaar” button

Punch in the details such as name, date of birth and gender. It will be already mentioned by you during registration on the e-Filing portal

Verify the details on screen with the ones mentioned on your Aadhaar card

If the details match, enter your Aadhaar card number and click on the “link now” button

You will get the message that your Aadhaar card has been successfully linked to your PAN card

Know how to link your PAN card with Aadhaar card – Here is the step by step explanation | Zee News