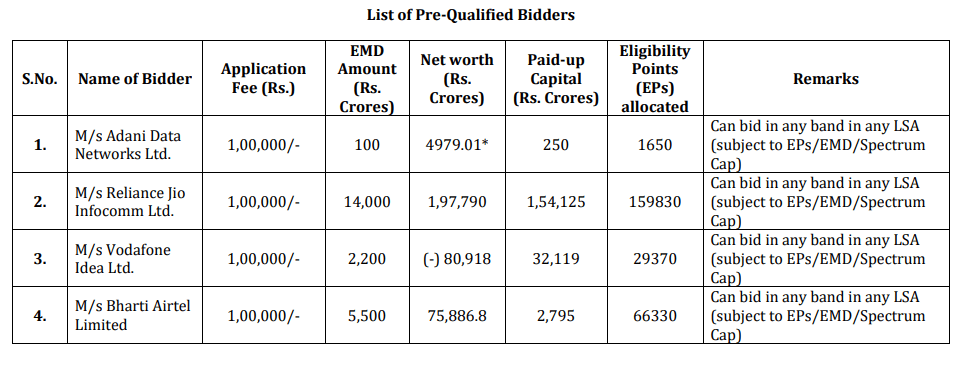

The Department of Telecommunications (DoT) today announced the list of pre-qualified bidders for the spectrum auction in 600 MHz, 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz, 2500 MHz, 3300 MHz, and 26 GHz bands.

The four applicants who had filed applications for participation in the spectrum auction have been confirmed as pre-qualified bidders. Reliance Jio has deposited the highest Earnest Money Deposit (EMD) for the auction, whereas Adani Data Networks has deposited the lowest Earnest Money Deposit (EMD) for the auction.

Teclos can bid for spectrum worth 6 to 7 times the amount of the EMD. The higher the EMD amount, the more eligibility points a telco gets to bid for the spectrum.

Adani Data Networks has submitted Rs 100 crore EMD amount. It has been allocated 1650 eligibility points (EP). It is eligible to bid in any band in any LSA subject to EPs/EMD/Spectrum Cap.

Reliance Jio has submitted Rs 14000 crore EMD amount. It has been allocated 159830 eligibility points (EP). It is eligible to bid in any band in any LSA subject to EPs/EMD/Spectrum Cap.

Vodafone Idea Limited has submitted Rs 2200 crore EMD amount. It has been allocated 29370 eligibility points (EP). It is eligible to bid in any band in any LSA subject to EPs/EMD/Spectrum Cap.

Lastly, Bharti Airtel has submitted Rs 5500 crore EMD amount. It has been allocated 66330 eligibility points (EP). It is eligible to bid in any band in any LSA subject to EPs/EMD/Spectrum Cap.

The Telecom Department has also taken Adani Data Network’s promoter Adani Enterprises’ net worth into consideration resulting in a net worth of Rs 4979.01 crore.

The amount of EMD indicates that Jio will be the most aggressive participant in the upcoming auction. Airtel will play a balanced approach while Vi will be on the fringes and bid selectively for spectrum. Adani Data Networks will have a limited impact on the bidding process and might bid

47 replies

Loading new replies...

Join the full discussion at the OnlyTech Forums →