In just over a month from today, we will witness the commencement of the spectrum auction which is slated to be a mega sale of the largest quantum of airwaves in the history of Indian telecom. In this article, I will be giving a bird’s-eye view of each of the 10 bands along with details of availability across the 22 telecom circles.

The validity of this spectrum will be 20 years from the date of allocation and operators will be free to use it for 2G/3G/4G or 5G network deployment at their discretion. For details about the band-wise existing spectrum holding of telecom operators and circle-wise spectrum caps, refer to our exclusive Spectrum holding chart 2022.

600 MHz

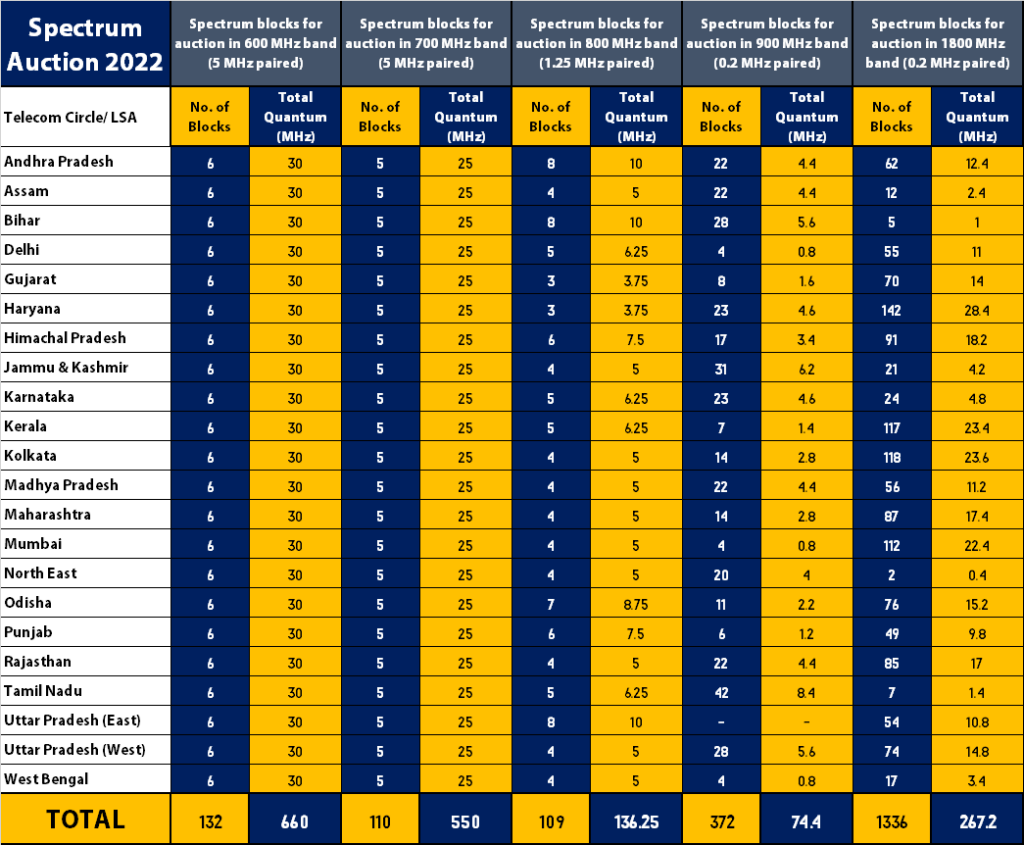

This is the first time that this band is being put up for sale in India. In fact, this band has not even been standardised by the ITU and is being auctioned as an FDD band labelled as APT 600 (Option B1) with a total bandwidth of 40 MHz paired, of which 10 MHz has been reserved for BSNL pan India and 30 MHz is being put up for auction in each of the 22 circles in a block size of 5 MHz. In the 4 circles of Himachal Pradesh, Jammu & Kashmir, North East and Uttar Pradesh West the spectrum in this band will not be assigned in the area within 50 KM of the international border.

700 MHz

This band had been put up for sale in the 2016 and 2021 auctions but failed to attract any bids from the operators on account of its high reserve price. This time around the base price has received a 40% cut and may pique the interest of one of the players. The bandwidth put up for sale in 2016 was 35 MHz then 5 MHz was allotted to Indian Railways and 30 Mhz was put up for sale in auction 2021, and now a further 5 MHz seems to have been reserved for metro rail networks pan India and a total of 25 MHz is being put up for sale in each of the 22 circles in a block size of 5 MHz.

850 MHz

This is a legacy band which was earlier being used for CDMA operations but is now used exclusively for 4G LTE deployments by various operators. Earlier the bandwidth available in this band was limited to 17.5 MHz due to the requirement of inter-carrier guard band requirements which have now been removed and the entire 20 MHz has been opened up for commercial deployments. Spectrum in this band has been put up for sale in a block size of 1.25 MHz but the last block in each of the 22 circles is limited to 0.75 MHz and may be converted to 1.25 MHz at a later date if DoT finds in its field trials that it does not interfere with operations in 900 MHz band.

900 MHz

This is also a legacy band, traditionally used for 2G GSM operations but now widely used for LTE network deployments due to its superior indoor coverage properties. Spectrum in this band held by the defence ministry and Indian Railways was recently surrendered by them which led to an increased availability with the DoT for commercial telecom deployment. Spectrum in this band is being put up for sale in a block size of 0.2 Mhz and the circle-wise details are shown in the table above.

1800 MHz

This is a legacy band used traditionally for 2G GSM services and more recently for 4G LTE services. There is a total bandwidth of 55 MHz in this band available for commercial telecom and recently the ministry of defence has vacated an additional 10 to 15 MHz in 5 circles taking the bandwidth to 65 to 70 MHz in these circles. Spectrum in this band has been put up for sale in a block size of 0.2 MHz. few of the Spectrum blocks in Haryana circle are not available in Sirsa and Fatehabad districts.

2100 MHz

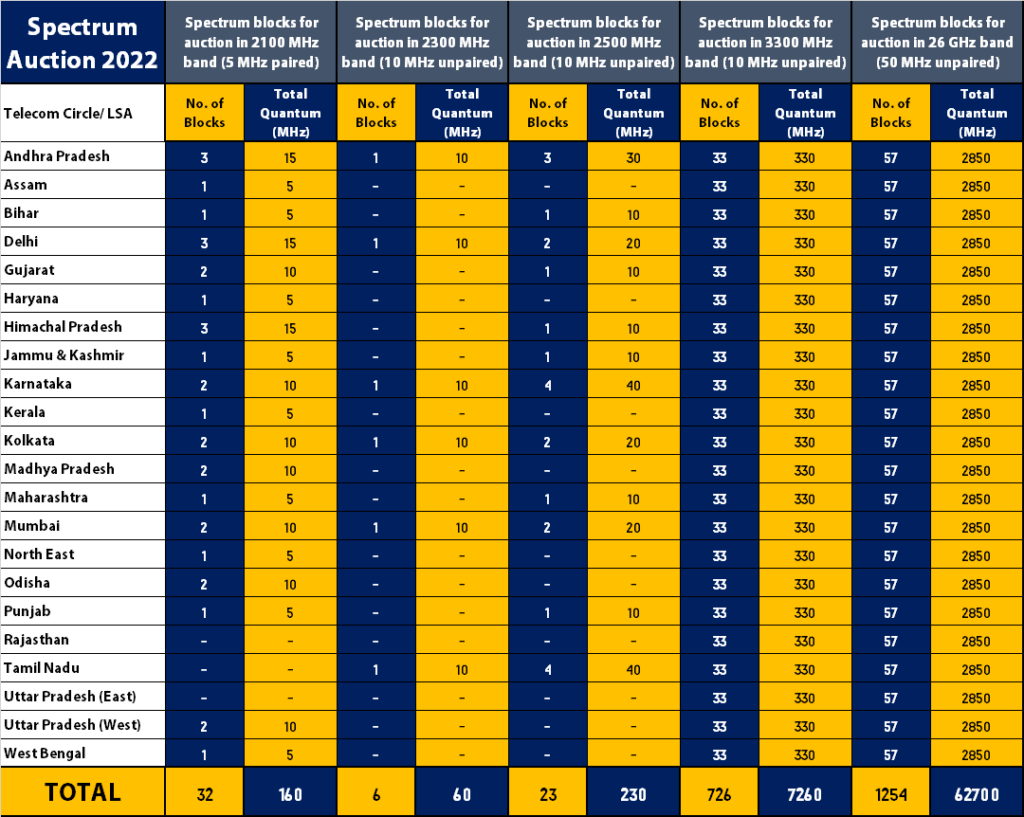

Spectrum in this band was first auctioned in 2010 and was conventionally used for 3G HSPA networks but has recently been refarmed for 4G LTE networks. The total bandwidth available for commercial telecom in this band is 40 MHz. Spectrum in this band has been put on sale in a block size of 5 MHz, the details of circle-wise availability have been shown in the table below.

2300 MHz

This is a TDD band which was first auctioned in 2010 and has traditionally been used as a capacity band for LTE networks. The total bandwidth available for commercial telecom is 80 MHz. Spectrum in this band is being put up for sale with a block size of 10 MHz and is available only in 6 out of the 22 telecom circles. The circle-wise availability has been shown in the table above.

2500 MHz

This is a TDD band which is used as an alternative for the 2300 MHz band to add capacity to LTE networks. Most of the bandwidth in this band is held by the Department of Space and just 40 MHz is available for commercial telecom. Spectrum in this band is being put up for sale with a block size of 10 MHz. The circle-wise availability has been shown in the table above.

3300 MHz

This is the first time that the mid-band spectrum is being put up for sale. This is the main 5G band (n78) which is supported by all 5G handsets. The total bandwidth in this band available for commercial telecom operations is 370 MHz out of which 40 MHz pan India has been reserved for BSNL and 330 MHz has been put up for auction in each of the 22 circles in a block size of 10 MHz. An operator can bid for a maximum of 130 MHz in this band in any given circle. In the circles of Himachal Pradesh, Jammu & Kashmir, Rajasthan, Gujarat, UP West and North East some of this spectrum will not be assigned within 50 KM of the international border.

26 GHz

This is the first time that the mm-wave spectrum is being put up for auction. This is the capacity band for 5G networks. A total bandwidth of 3250 MHz is available in this band for commercial telecom, out of which 400 MHz has been reserved for BSNL whereas 2850 MHz has been put up for sale across the 22 circles in a block size of 50 MHz. An operator can bid for a maximum of 1100 MHz in this band in any given circle. In the circles of Delhi, Andhra Pradesh, Gujarat, Tamil Nadu and West Bengal some of the blocks will not be assigned within a 2.7 KM radius of a particular location in each of these circles.

@esmail

Awesome job, man!

@esmail 🙏🏽👍🏽