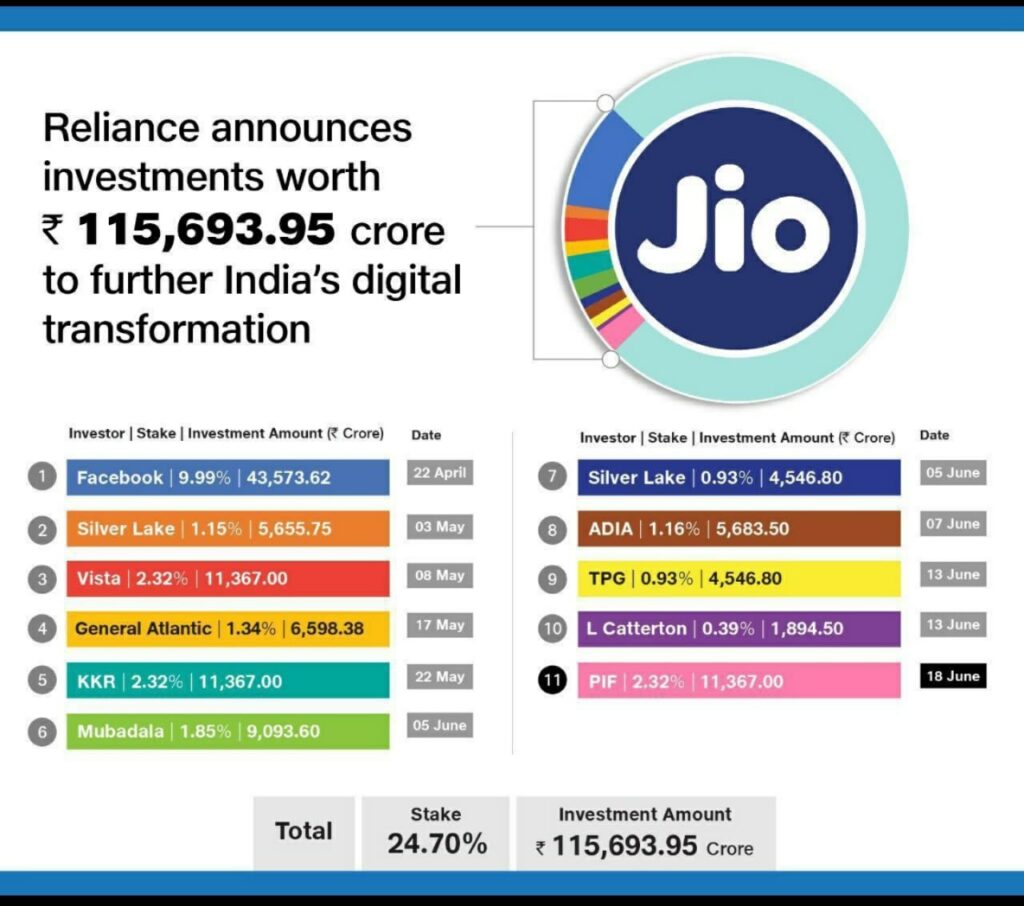

Saudi Arabia backed Public Investment Fund (PIF) has picked a 2.32% stake in Jio Platforms at Rs 11,367 crore becoming the 10th investor to pick up a minority stake in Jio Platforms. The investment values Jio Platforms at an equity value of ₹ 4.91 lakh crore and an enterprise value of ₹ 5.16 lakh crore.

Jio Platforms has now raised Rs 115,693.95 crore from Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubudala, ADIA, TPG, L Catterton and PIF in 11 separate transactions resulting in a stake sale of 24.7% which is likely to continue to rise. The 11 stake sales have happened in the last 2 months with Facebook first announcing the stake acquistion on 22 April.

Jio Platforms Stake Sale – At a Glance

- Facebook – 9.99% (Rs 43,573.62 Crore)

- Silver Lake Partners – 1.15% (Rs 5,656.75 Crore)

- Vista Equity Partners – 2.32% (Rs 11,367 Crore)

- General Atlantic – 1.34% (Rs 6,598.38 Crore)

- KKR – 2.32% (Rs 11,367 Crore)

- Mubudala – 1.85% (Rs 9,093.6 Crore)

- Silver Lake Partners (Second Investment) – 0.93% (Rs 4,546.8 Crore)

- Abu Dhabi Investment Authority – 1.16% (Rs 5,683.5 Crore)

- TPG – 0.93% (Rs 4546.8 Crore)

- L Catterton – 0.39% (Rs 1894.5 Crore)

- PIF – 2.32% (Rs 11,367 Crore)

Mukesh Ambani, Chairman and Managing Director of Reliance Industries, said, “We at Reliance have enjoyed a long and fruitful relationship with the Kingdom of Saudi Arabia for many decades. From Oil Economy, this relationship is now moving to strengthen India’s New Oil (Data-driven) Economy, as is evident from PIF’s investment into Jio Platforms. I have greatly admired the defining role PIF has played in driving the economic transformation of the Kingdom of Saudi Arabia. I welcome PIF as a valued partner in Jio Platforms and look forward to their sustained support and guidance as we take ambitious steps to accelerate India’s digital transformation for enriching and empowering the lives of 1.3 billion Indians.”

We are delighted to be investing in an innovative business which is at the forefront of the transformation of the technology sector in India. We believe that the potential of the Indian digital economy is very exciting and that Jio Platforms provides us with an excellent opportunity to gain access to that growth. This investment will also enable us to generate significant long-term commercial returns for the benefit of Saudi Arabia’s economy and our country’s citizens, in line with our mandate to safeguard and grow the national wealth of the Kingdom.”

His Excellency Yasir Al-Rumayyan, Governor of PIF

The transaction as with all other deals remains subject to customary and regulatory approvals. CCI is currently looking into the Facebook-Jio deal. As with all the other Jio Platforms stake sale, Morgan Stanley was the financial advisor for Reliance Jio with AZB & Partners, and Davis Pol & Wardwell acting as the legal counsel.