The start of the second quarter of 2021 saw Reliance Jio regaining its mojo in wireless subscriber additions with a clear lead over other operators. Though Jio added the highest number of subscribers in April, Airtel still has more active monthly users than Jio as per TRAI VLR data. Vodafone Idea and BSNL both continued to lose subscribers ceding ground to Airtel and Jio and fueling the fear of the market heading towards a potential duopoly.

The overall wireless subscriber base increased by 2.15 million from 1180.96 million at the end of March to 1183.11 million at the end of April 2021. The overall wireline subscriber base increased marginally by 0.12 million from 20.24 million at the end of March to 20.36 million at the end of April 2021.

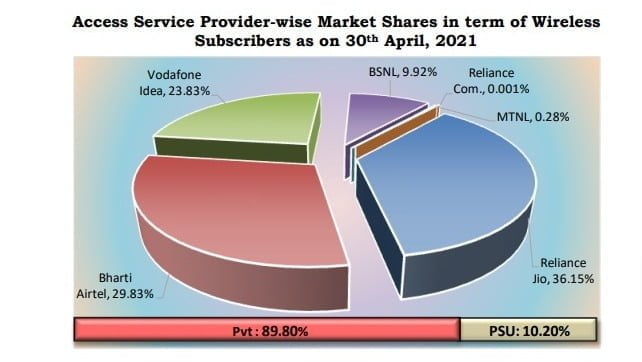

Wireless Subscriber Market share:

As of 30th April 2021, Reliance Jio is leading with 36.15% wireless subscriber market share which translates to 427.67 million subscribers, Bharti Airtel is at second position with 29.83% market share (352.91 million subscribers), whereas Vodafone Idea comes third with 23.83% market share (281.90 million subscribers). BSNL commands 9.92% (117.33 million) while MTNL commands just 0.28% market share (3.29 million).

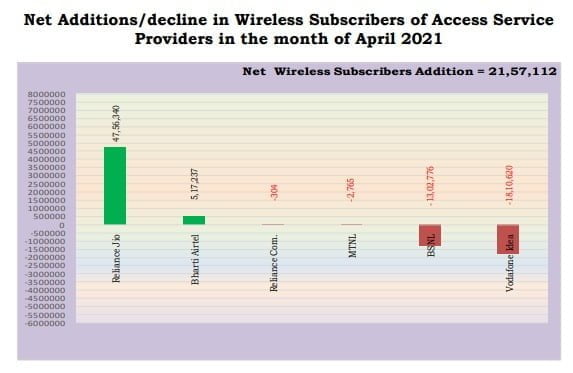

Wireless Subscriber Gain/Loss in April

Reliance Jio led the new wireless subscriber addition race in April 2021 with 4.7 million net additions, Bharti Airtel followed with 0.5 million wireless subscriber additions. Vodafone Idea continued its subscriber loss streak with a 1.8 million net loss in April. BSNL lost over 1.3 million wireless subscribers while MTNL lost over 2.7 thousand.

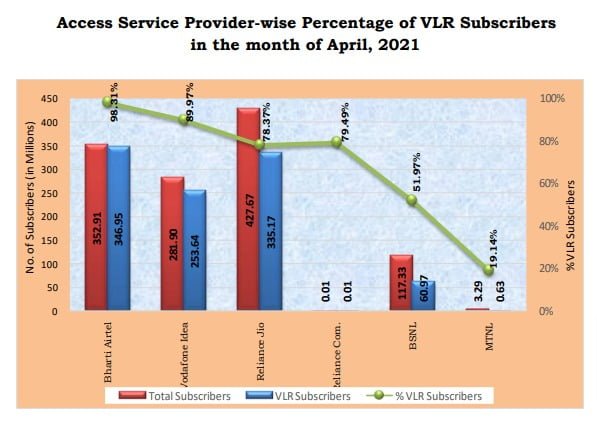

Active subscriber base, VLR data:

Visitor location register (VLR) is an indicator of what percentage of the total subscriber base is comprised of active users. Bharti Airtel leads the race with a VLR score of over 98% and has the lowest inactive user base of 5.96 million, it is followed by Vodafone Idea with a score of nearly 90% (inactive user base 28.26 million). Reliance Jio has a VLR score of over 78% (inactive user base 92.5 million), whereas BSNL lags behind with a score of nearly 52% (inactive user base 56.36 million) and MTNL finishes last with a VLR score of over 19% (inactive user base 2.66 million).

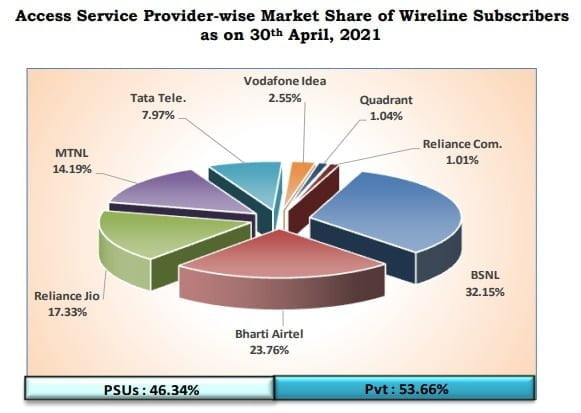

Wireline subscriber market share:

Private operators (read Jio and Airtel) continued to reclaim the market dominance in this segment from PSU operator BSNL which had for long enjoyed the supreme position due to lack of competition from private operators. BSNL continues to lead with a 32.15% share of the wireline subscriber market share in April 2021, which translates to 6.54 million subscribers. Bharti Airtel at the second spot commands a 23.76% share (4.83 million subscribers). Reliance Jio has jumped up to the third position with a 17.33% market share (3.52 million). MTNL follows at the fourth spot with a 14.19% share (2.88 million subscribers). Vodafone Idea holds only 2.55% share (0.51 million subscribers).

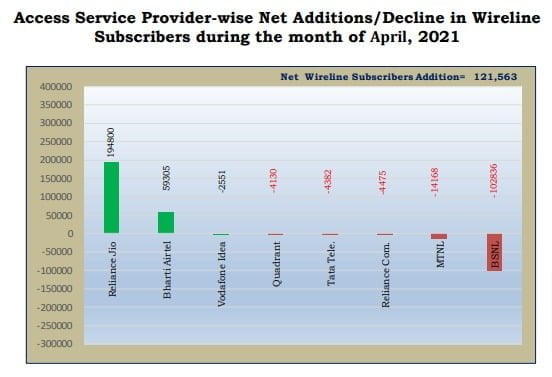

Wireline Subscriber Gain/Loss in April:

Reliance Jio added over 1.9 lakh new wireline connections in April 2021, followed by Bharti Airtel who added over 59 thousand new connections. Vodafone Idea added over 2.5 thousand wireline connections whereas MTNL lost over 14 thousand. BSNL continued the trend of losing subscribers with the loss of over 1 lakh connections in April.

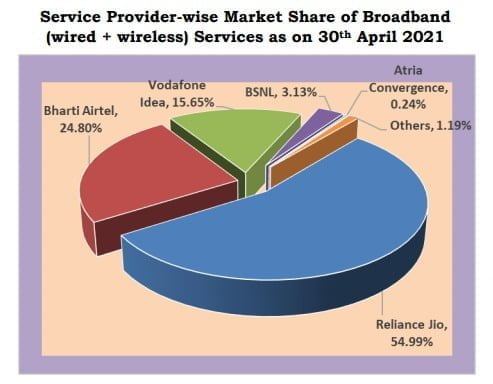

Broadband subscriber market share:

Broadband is considered when the speed offered is higher than 512 Kbps irrespective of it being a wired or wireless connection. As on 30th April 2021, the top five Wired Broadband Service providers by subscriber base were BSNL (6.03 million), Bharti Airtel (3.19 million), Reliance Jio Infocom Ltd (2.8 million), Atria Convergence Technologies (1.87 million), and Hathway Cable & Datacom (1.08 million). The top five Wireless Broadband Service providers were Reliance Jio Infocom Ltd (427.67 million), Bharti Airtel (190.99 million), Vodafone Idea (122.53 million), BSNL (18.49 million) and Tikona Infinet (0.32 million).

MTNL takes Ages for 14 % market Share but Jio garnered in Few Month’s

MTNL operates in 2 circles whereas Jio operates in 22 circles so yes they have the upper hand there. But even so, Jio provides way better service and tariff so this was bound to happen. It’s not long before Jio overtakes Airtel to become the second largest wired service provider and in due course both Jio and Airtel will overthrow BSNL from its top position in this segment.