September turned out to be a month of contrast for Reliance Jio, where on one hand it saw its wireline subscriber additions pick up momentum, on the other hand its wireless subscriber additions seemed to be losing steam. Airtel in comparison reported a robust wireless subscriber addition while Vodafone Idea continued the saga of heavy subscriber losses.

The overall wireless subscriber base increased marginally by 0.66 million from 1147.92 million at the end of August to 1148.58 million at the end of September 2020. The overall wireline subscriber base also increased marginally by 0.19 million from 19.89 million at the end of August to 20.08 million at the end of September 2020.

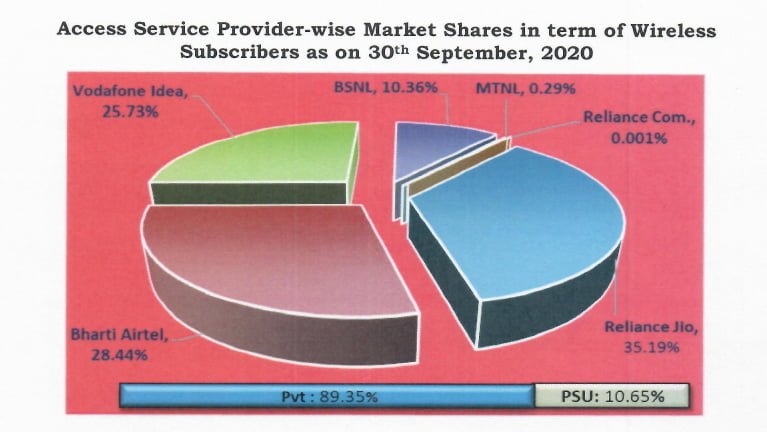

Wireless Subscriber Market share:

As of 30th September 2020 Reliance Jio is leading with 35.19% wireless subscriber market share which translates to 404.18 million subscribers, Bharti Airtel is at second position with 28.44% market share (326.65 million subscribers), whereas Vodafone Idea comes third with 25.73% market share (295.52 million subscribers). BSNL commands 10.36% (118.99 million) while MTNL commands just 0.29% market share (3.33 million).

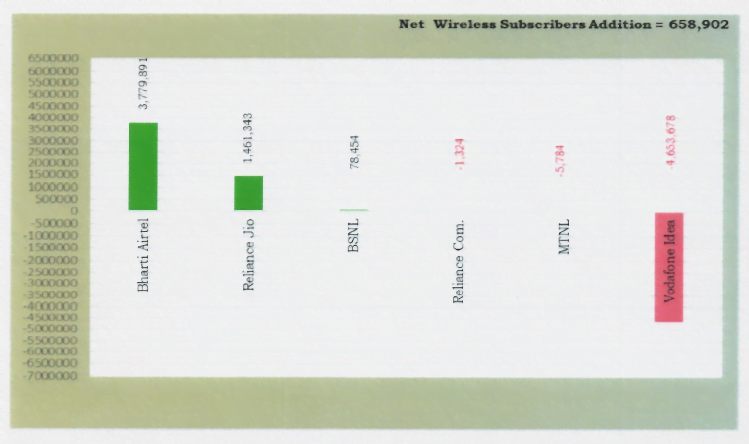

Wireless Subscriber Gain/Loss in September:

Bharti Airtel led the new wireless subscriber addition race in September 2020 with 3.7 million net additions, Reliance Jio was close on its heels with 1.4 million net adds, while BSNL added over 78 thousand new wireless subscribers. Vodafone Idea lost over 4.6 million subscribers in September while MTNL lost over 5.7 thousand.

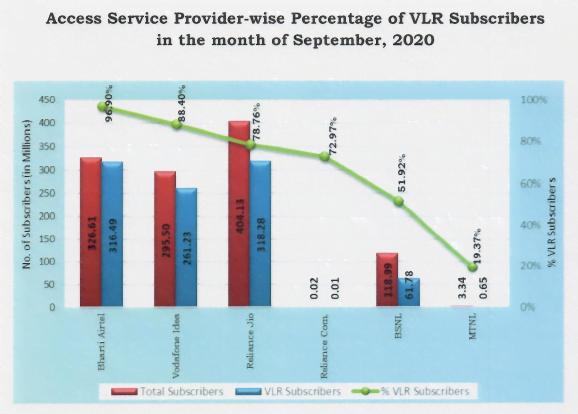

Active subscriber base, VLR data:

Visitor location register (VLR) is an indicator of what percentage of the total subscriber base is comprised of active users. Bharti Airtel leads the race with a VLR score of over 96% which implies it has the lowest inactive user base of 10.12 million, it is followed by Vodafone Idea with a score of 88% (inactive user base 34.27 million). Reliance Jio has a VLR score of over 78% (inactive user base 85.85 million) whereas BSNL lags behind with a score of 52% (inactive user base 57.21 million).

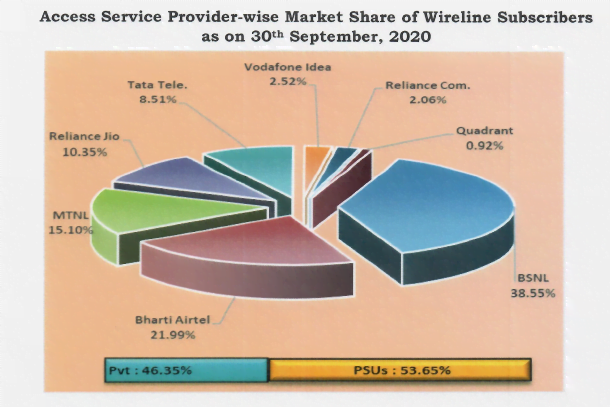

Wireline subscriber market share:

BSNL continues to lead with 38.55% share of the wireline subscriber market share in September 2020, which translates to 7.74 million subscribers. Bharti Airtel commands 21.99% share (4.41 million subscribers). MTNL follows with 15.10% share (3.03 million subscribers). Reliance Jio holds 10.35% share (2.07 million subscribers). Vodafone Idea holds only 2.43% share (0.48 million subscribers).

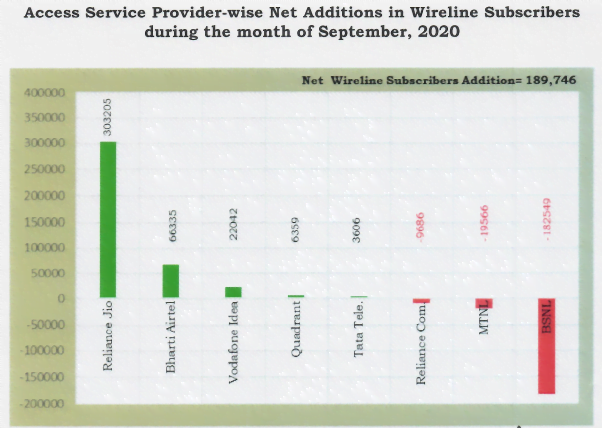

Wireline Subscriber Gain/Loss in September:

Reliance Jio added over 3 lakh new wireline connections in September 2020, followed by Bharti Airtel who added over 66 thousand new connections. Vodafone Idea added over 22 thousand new wireline connections whereas MTNL lost over 19 thousand. BSNL continued the trend of losing subscribers with the loss of over 1.8 lakh connections in September.

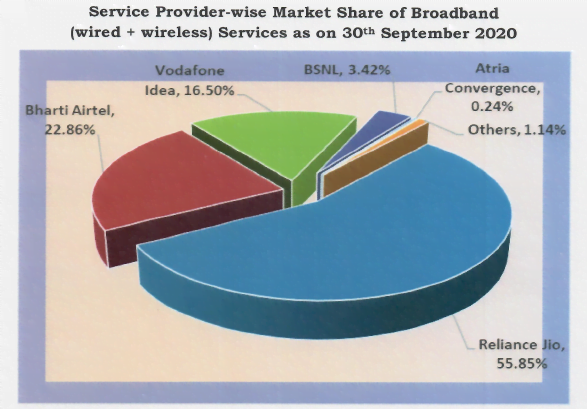

Broadband subscriber market share:

Broadband is considered when the speed offered is higher than 512 Kbps irrespective of it being a wired or wireless connection. As on 30th September 2020, the top five Wired Broadband Service providers by subscriber base were BSNL (7.80 million), Bharti Airtel (2.60 million), Atria Convergence Technologies (1.73 million), Reliance Jio Infocom Ltd (1.52 million) and Hathway Cable & Datacom (1.05 million). The top five Wireless Broadband Service providers were Reliance Jio Infocom Ltd (404.13 million), Bharti Airtel (163.41 million), Vodafone Idea (119.84 million), BSNL (17.03 million) and Tikona Infinet (0.31 million).