The fifth month of lockdown saw Reliance Jio become the first Indian telecom operator to cross the 400 million subscriber mark through organic route, though technically Vodafone Idea had achieved that milestone through the merger and acquisition route earlier. Both Jio and Airtel showed healthy wireless subscriber addition figures while Vi continued the trend of losing subscribers.

The overall wireless subscriber base increased marginally by 0.3% from 1140.71 million at the end of June to 1144.18 million at the end of July 2020. The overall wireless tele-density also grew marginally by 0.11% from 133.53% at the end of June to 133.64% at the end of July 2020.

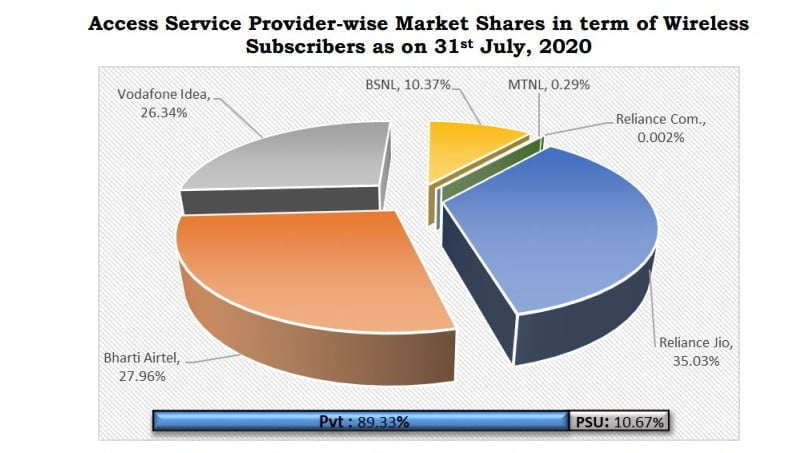

Wireless Subscriber Market share:

As of 31st July, 2020 Reliance Jio is leading with 35.03% wireless subscriber market share which translates to 400.8 million subscribers, Bharti Airtel is at second position with 27.96% market share (319.91 million subscribers), whereas Vodafone Idea comes third with 26.34% market share (301.37 million subscribers). BSNL commands 10.37% (118.65 million) while MTNL commands just 0.29% market share (3.31 million).

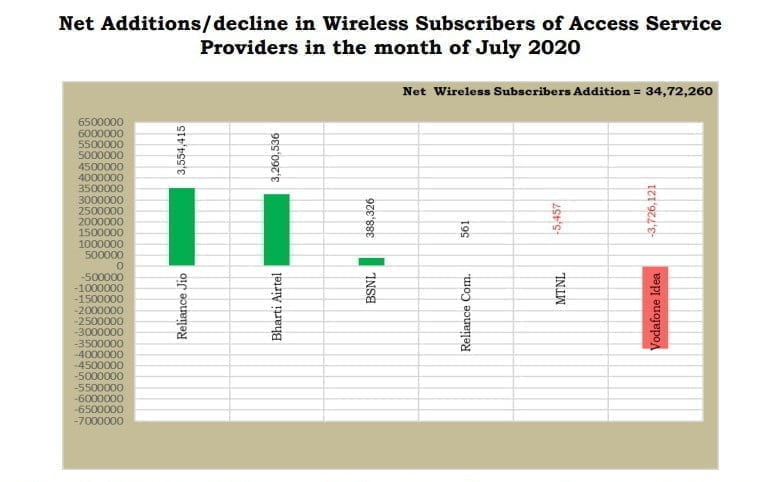

Wireless Subscriber Gain/Loss in July:

Reliance Jio led the new wireless subscriber addition race in July 2020 with 3.5 million net additions, Bharti Airtel was close on its heels with 3.2 million net adds, while BSNL added 0.38 million new wireless subscribers. Vodafone Idea lost over 3.7 million subscribers in July while MTNL lost over 5.4 thousand.

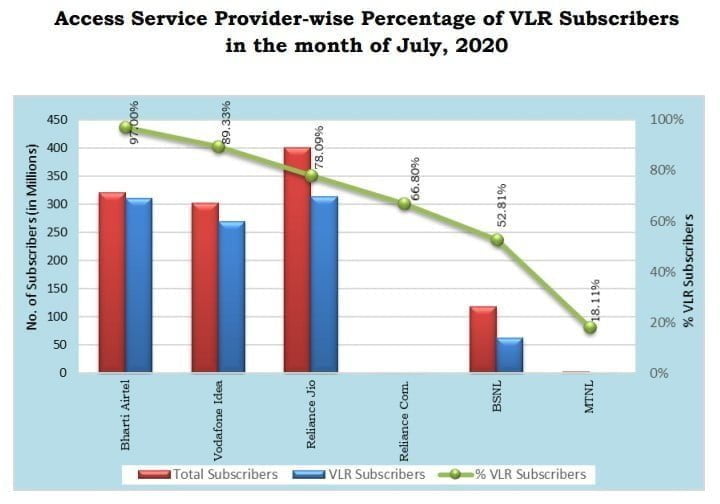

Active subscriber base, VLR data:

Visitor location register (VLR) is an indicator of what percentage of the total subscriber base is comprised of active users. Bharti Airtel leads the race with a VLR score of 97% which implies it has the lowest inactive user base of 9.5 million, it is followed by Vodafone Idea with a score of 89% (inactive user base 32 million). Reliance Jio has a VLR score of 78% (inactive user base 87.8 million) whereas BSNL lags behind with a score of 52% (inactive user base 56 million).

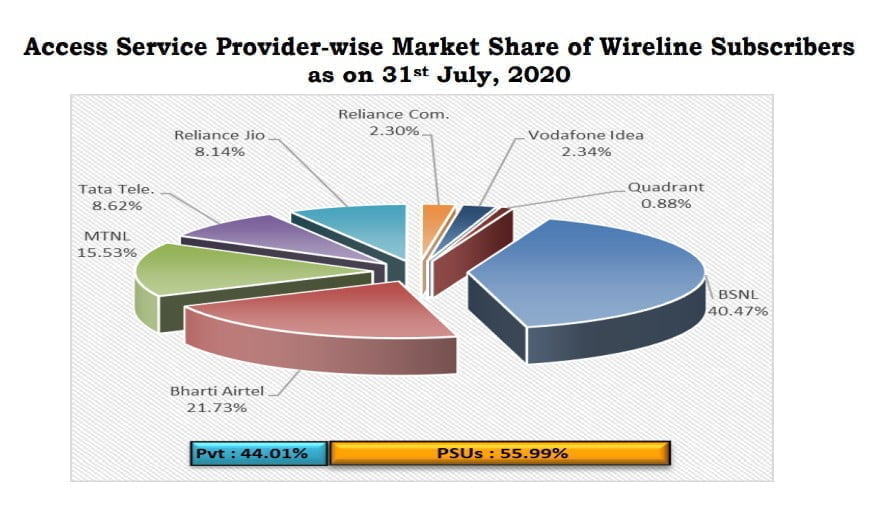

Wireline subscriber market share:

BSNL continues to lead with 40.47% share of the wireline subscriber market share, which translates to 8.02 million subscribers. Bharti Airtel commands 21.73% share (4.30 million subscribers). MTNL follows with 15.53% share (3.07 million subscribers). Reliance Jio holds 8.14% share (1.61 million subscribers). Vodafone Idea holds only 2.34% share (0.46 million subscribers).

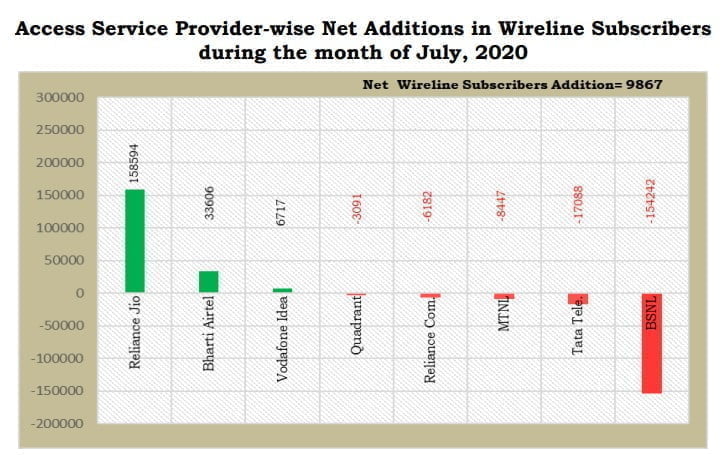

Wireline Subscriber Gain/Loss in July:

Reliance Jio added over 1.5 lakh new wireline connections in July 2020, followed by Bharti Airtel who added over 33 thousand new connections. Vodafone Idea added over 6.7 thousand new wireline connections whereas MTNL lost over 8.4 thousand. BSNL continued the trend of losing subscribers with the loss of over 1.5 lakh connections in July.

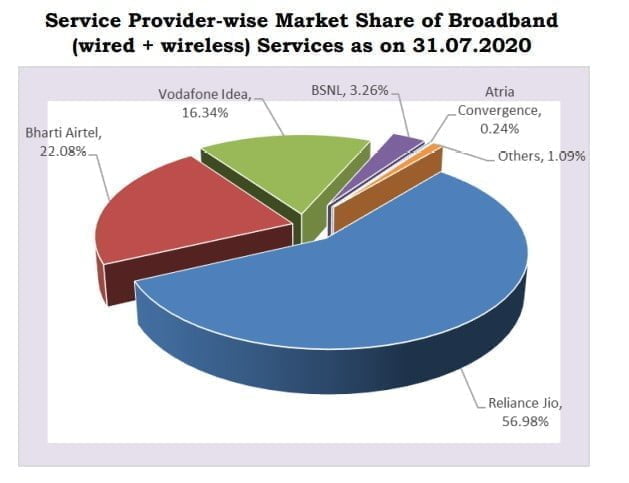

Broadband subscriber market share:

Broadband is considered when the speed offered is higher than 512 Kbps irrespective of it being a wired or wireless connection. As on 31st July 2020, the top five Wired Broadband Service providers by subscriber base were BSNL (7.86 million), Bharti Airtel (2.49 million), Atria Convergence Technologies (1.69 million), Reliance Jio Infocom Ltd (1.16 million) and Hathway Cable & Datacom (1.01 million). The top five Wireless Broadband Service providers were Reliance Jio Infocom Ltd (400.80 million), Bharti Airtel (153.25 million), Vodafone Idea (115.26 million), BSNL (15.17 million) and MTNL (0.30 million).

In Mumbai and Delhi metro circles, MTNL lost 5457 mobile customers and active base is JUST 18% according to VLR data??? May be only MTNL staff are using those connections to check “Salary credited SMS”. BSNL is 1000 times better than MTNL, imho.

Yes, that is why the government has decided to expand BSNL to cover Mumbai and Delhi circles as well, making it a truly Pan India operator and converting MTNL into a virtual network operator (VNO) running on the BSNL infrastructure and handling the customer side operations on both wired and wireless connection. MTNL 2G spectrum which was supposed to expire in 2017 got a 4 year extension free of cost and is now finally expiring early next year, after that it will be renewed as liberalised spectrum under BSNL not MTNL.

At least I can see BSNL logos in the recharge shops in Tamilnadu.

I couldn’t see even a single MTNL logo when I visited Navi Mumbai area on June 2018.