The telecom regulator has released the subscription data report for April 2020 which reveals that Reliance Jio has managed to add new wireless subscribers in the month of April even in the midst of the national lockdown on account of Covid-19, while incumbent operators Bharti Airtel and Vodafone Idea have cumulative net losses in subscriber base. We get to see the full impact of the Covid-19 lockdown as migrant workers return home and let go of extra connections to save on expenses. Vodafone Idea continues to bleed due to the uncertainty of operations in India.

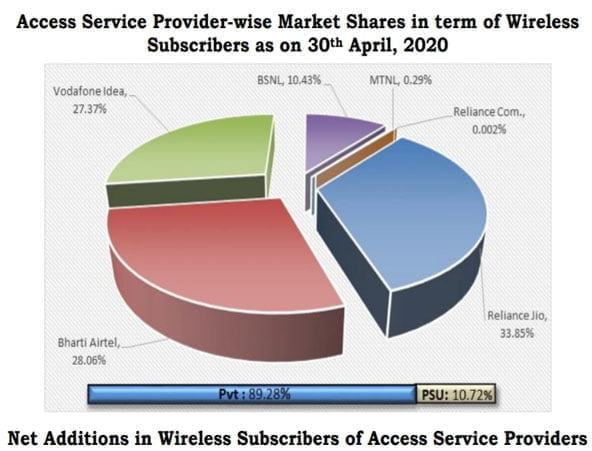

Wireless Subscriber Market share:

As of 30th April, 2020 Reliance Jio is leading with 33.85% market share which translates to 389.11 million subscribers, Bharti Airtel is at second position with 28.06% market share (322.55 million subscribers), whereas Vodafone Idea comes third with 27.37% market share (314.62 million subscribers). BSNL commands 10.43% (119.89 million) while MTNL commands just 0.29% market share (3.33 million).

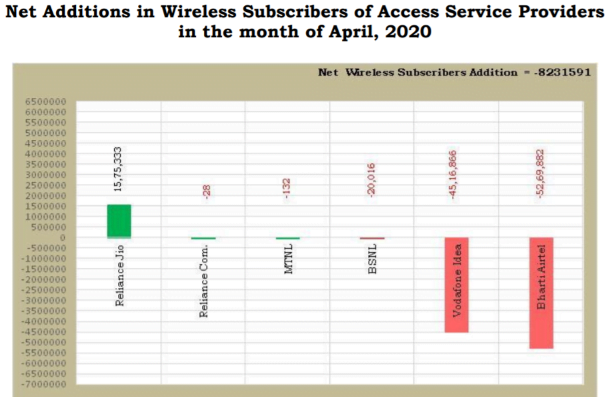

Net Subscriber Gain/Loss in April:

Jio was the only operator who managed to add new wireless subscribers in April with 1.57 million net additions. Bharti Airtel lost a whopping 5.26 million subscribers while Vodafone Idea ended up losing over 4.51 million on account of the uncertainty of the Operator’s future in India after the Supreme court’s ruling on the AGR dues. BSNL lost over 20 thousand subscribers, meanwhile, MTNL lost 132 subscribers in April.

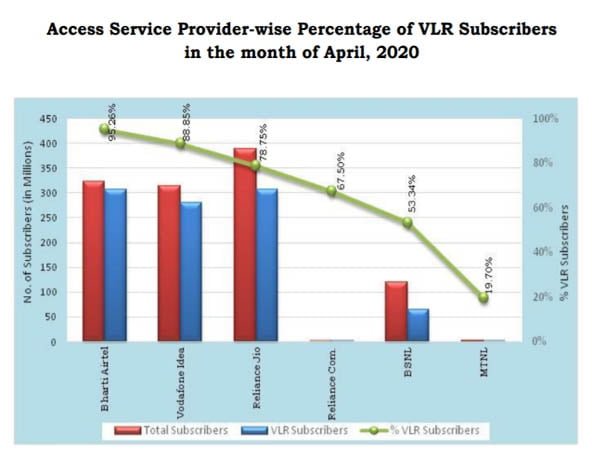

Active subscriber base, VLR data:

Visitor location register (VLR) is an indicator of what percentage of the total subscriber base is comprised of active users. Bharti Airtel leads the race in VLR numbers with over 95% of its user base being active, it is followed by Vodafone Idea with nearly 89%, Reliance Jio has nearly 79% whereas BSNL lags behind with only 53% of its total user base being active.

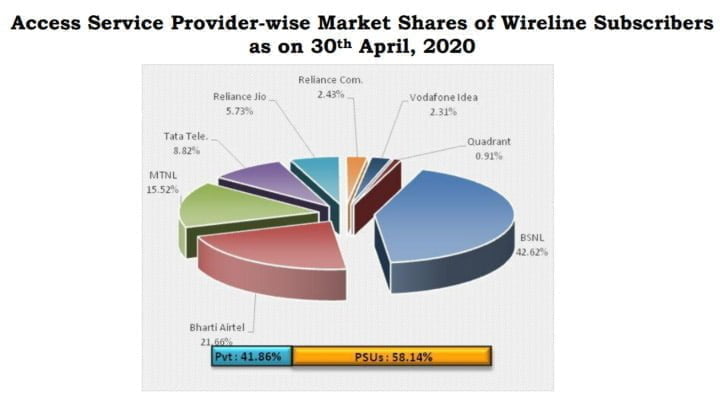

Wireline subscriber market share:

BSNL continues to lead with 42.62% share of the wireline subscriber market, even though it lost over 2.37 lakh subscribers in April 2020. Bharti Airtel commands 21.66% share though it lost over 77 thousand subscribers. MTNL follows with 15.52% share, though it lost over 2 thousand subscribers. Reliance Jio holds 5.73% share as it added over 50 thousand subscribers. Vodafone Idea holds only 2.31% share as it added over 4.2 thousand subscribers in April 2020.

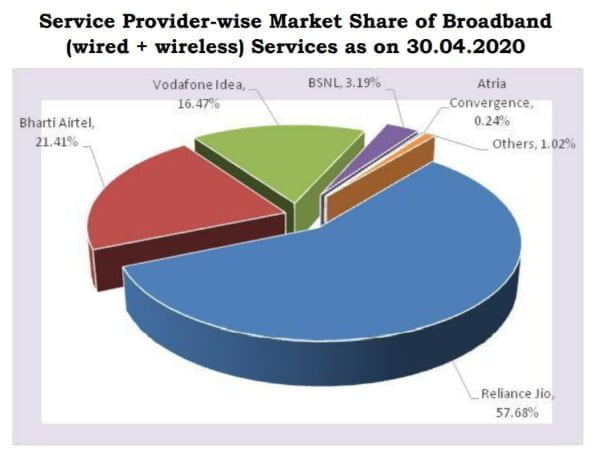

Broadband subscriber market share:

Broadband is considered when the speed offered is higher than 512 Kbps irrespective of it being a wired or wireless connection. As on 3oth April 2020, the top five Wired Broadband Service providers by subscriber base were BSNL (7.97 million), Bharti Airtel (2.44 million), Atria Convergence Technologies (1.59 million), Hathway Cable & Datacom (0.97 million) and Reliance Jio Infocom Ltd (0.90 million). The top five Wireless Broadband Service providers were Reliance Jio Infocom Ltd (389.09 million), Bharti Airtel (142.33 million), Vodafone Idea (111.36 million), BSNL (13.56 million) and MTNL (0.17 million).