Spectrum is for telecommunication what jet fuel is for aviation. Spectrum is a range of electromagnetic frequencies or airwaves that telecom companies use for establishing a connection between a cell tower and a mobile phone. The bandwidth of this spectrum is directly proportional to the speed of a wireless data network (since more data can be transmitted simultaneously through a broader data pipeline). In contrast, the frequency is inversely proportional to the coverage (since lower frequencies penetrate better through physical barriers and thus have wider coverage).

The spectrum holding data sheet embedded in this article represents the current spectrum holdings of all active telecom operators across all frequency bands across all 22 telecom circles along with their liberalisation status and expiry dates. All figures represented are in MHz. The value mentioned in the bracket beside the frequency at the base of each sheet is the band number where ‘B’ stands for 4G LTE band whereas ‘n’ stands for the corresponding 5G NR band.

The spectrum shown under BSNL and Aircel in white is reserved for the respective operators but has not yet been officially allotted to them.

Spectrum Liberalisation:

Spectrum was administratively allocated to operators in each of the 22 licensed service areas or circles prior to 2010, this spectrum is called non-liberalised and can only be used for 2G services whereas all airwaves allotted post-2010 have been through a Spectrum Auction where operators have paid the market discovered price and this spectrum is called liberalised and can be used for any technology platform 2G/3G/4G/5G. Alternatively, operators may choose to liberalise their administratively allotted spectrum by paying the market-discovered price to DoT on a pro-rata basis for the remaining validity of the spectrum.

Paired and Unpaired spectrum:

Spectrum may be paired or unpaired, bands 1/3/5/8/28 are all paired where one set of frequencies is used for uplink whereas another distinct set of frequencies is used for downlink known as Frequency-division duplexing (FDD), whereas bands 40/41/78/258 are unpaired where both uplink and downlink happens in the same set of frequencies separated by the time of uplink and downlink known as Time-division duplexing (TDD).

List of Indian FDD Bands:

| 4G LTE band | 5G NR band | Uplink frequency range (MHz) | Downlink frequency range (MHz) | Bandwidth for telecom (MHz) | Block size (MHz) |

|---|---|---|---|---|---|

| B1 | n1 | 1939-1979 | 2129-2169 | 40×2 | 5×2 |

| B3 | n3 | 1710-1780 | 1805-1875 | 70×2 | 0.2×2 |

| B5 | n5 | 824-844 | 869-889 | 20×2 | 1.25×2 |

| B8 | n8 | 890-915 | 935-960 | 25×2 | 0.2×2 |

| B28 | n28 | 723-733/ 738-748 | 778-788/ 793-803 | 20×2 | 5×2 |

List of Indian TDD Bands:

| 4G LTE band | 5G NR band | Frequency range (MHz) | Bandwidth for telecom (MHz) | Block size (MHz) |

|---|---|---|---|---|

| B40 | n40 | 2300-2380 | 80 | 10 |

| B41 | n41 | 2535-2555/ 2615-2655 | 60 | 10 |

| – | n78 | 3300-3670 | 370 | 10 |

| – | n258 | 24250-27500 | 3250 | 50 |

Spectrum caps:

A spectrum cap dictates how much spectrum a particular operator can hold in a circle for a specific band. There is a 40% cap for Sub-GHz spectrum in the 700/850/900 MHz bands combined, a 40% cap for Mid-Band spectrum in the 1800/2100/2300/2500 MHz bands combined, a 40% cap for the C-Band spectrum of 3300-3670 MHz and a 40% cap for the mm-Wave spectrum bands of 24.25-27.5 GHz. The current spectrum caps are denoted in the spectrum chart.

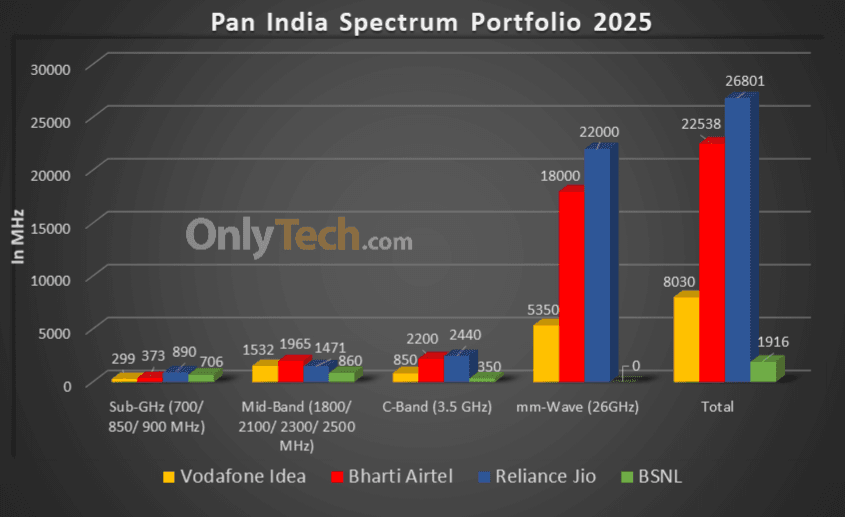

Overall spectrum holdings of operators (in MHz):

| Operator/Holding | Jio | Airtel | Vi | BSNL |

|---|---|---|---|---|

| Sub-GHz | 890 | 373.2 | 298.8 | 706 |

| Mid Band | 1470.8 | 1964.9 | 1531.6 | 860 |

| C-Band | 2440 | 2200 | 850 | 350 |

| mm-Wave Band | 22000 | 18000 | 5350 | 0 |

| Total | 26,800.8 | 22,538.1 | 8,030.4 | 1,916 |

Spectrum sharing/trading/leasing guidelines:

- Telecom operators holding CMTS/UASL/UL licenses can enter into a Spectrum-Sharing agreement with each other so long as both parties hold liberalised spectrum in the same band in the same circle. Spectrum sharing is possible only on a Pan LSA level in block sizes defined by DoT and only after one year of an operator acquiring the spectrum.

- Telecom operators holding CMTS/UASL/UL licenses can enter into a Spectrum-Trading agreement with each other so long as the spectrum being sold is liberalised. Trading of spectrum is possible only on a Pan LSA level in block sizes defined by DoT and only after two years of an operator acquiring the spectrum.

- Telecom operators may enter into a Spectrum-Leasing agreement only with Enterprises holding a Captive Non-Public Network (CNPN) license and not with each other. The lease may be limited to any geographic area within the LSA and for any duration mutually agreed upon by both parties. A CNPN licensee can lease spectrum from multiple operators within an LSA.

Note: We update this chart in real-time to ensure it is always up to date with the latest changes in spectrum holding. Certain human errors might have crept in during the manual compilation of the data, any mistakes/ rectification can be brought to the Team’s notice through the comments section below.

Esmail,

1) When is the spectrum auction expected to be held?

2) whats your guess on when Airtel & Vodafone Idea will increase their tariffs?

3) Whwn will Vodafone Idea integrate completely in Mumbai & Maharashtra?And will they survive at all?

Will be grateful of tou kindly answer thw above questions. Thanks & Regards

1) Between Jan to March 2020

2) Both of them will most probably increase tariffs around Jan 2020 since the AGR issue has left them stripped of liquid cash and they need to replenish it to survive. Also with Jio charging for outgoing IUC now the pricing pressure on them has been lifted which gives them some headroom for a 20% tariff hike for the all in one bundled packs.

3) Integration is going on in full swing, and they are surprisingly ahead of schedule. In Mumbai when I do a network scan I can see only Vodafone 2G/3G/4G network while Idea only has a 2G presence. Vodafone will be predominant in Mumbai whereas idea will be predominant in Maharashtra Circle.

About survival it seems like it can go either way right now with the AGR ruling and the company not having any reserve cash provisioned for it and Vodafone UK having cut all funding to Vodafone India. But they can still monetize their holding in Indus towers or sell off some spectrum to Jio before the auction or by selling bulk data and voice minutes to an MVNO who may want to use its network.

VIL will surely not participate in the upcoming auction as they won’t have the requisite Ernest money to deposit and they are anyway in a state of spectrum surplus.

@esmail here in Chennai VIL integration is going in snail pace. Still both networks are running.

OMG! Great to see you esmail… missed your knowledge & insight a lot 🙂 Request to kindly bring a lot of telecom news & analysis/opinion on this website, so that we can dump TT/Arrogant & Rude Chakri for good!

I will try my best to get a balance between Telecom and DTH news so that Telecom oriented readers are not left disappointed.