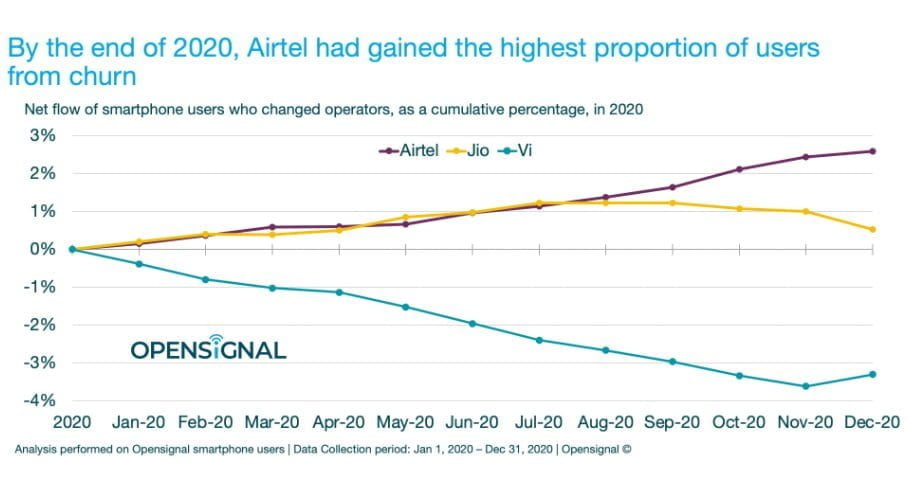

OpenSignal has analysed the trend of subscriber churn in India all through 2020 and charted the performance of the 3 private operators to quantify the net gainer and net loser of wireless subscribers in the process of churn. It turns out that Vi lost the most number of subscribers and most of these decided to port to Airtel network while Jio had a flattish curve with respect to churn subscriber additions.

In this analysis, Opensignal analyzed the mobile experience of Indian smartphone users who changed their mobile network service provider (Leavers) in 2020 after all three leading operators raised their tariffs in December 2019. It calculated the proportion of Leavers that each mobile operator lost and gained out of the total number of Leavers. Then, for each mobile operator, they calculated the difference between those two calculated proportions to find the net flow of Leavers. Note that there are still significant numbers of feature phone users in India, so Opensignal’s analysis represents a proportion of each mobile operator’s base, not all users.

Opensignal’s data shows that until August 2020, Airtel and Jio had been steadily gaining smartphone users, and in this period, both operators were neck and neck in the net users gained. From September onwards, when carriers once again decided to hike prices, Airtel continued to gain users until the end of the year. However, that trend on Jio’s network more or less flattened and then gradually started to decline — the negative trend was more pronounced from mid-November onwards. In contrast, Vi had been steadily losing customers since the beginning of the year and only started to see a deceleration of this trend from mid-November onwards.

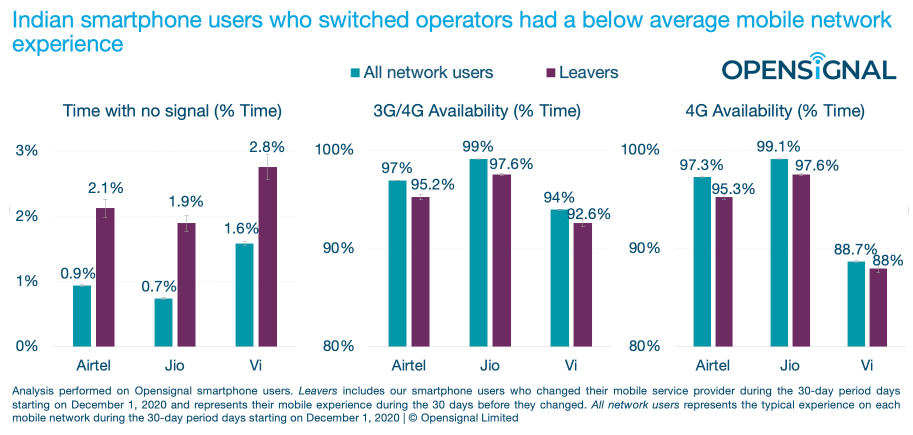

Opensignal also analyzed the mobile experience of smartphone Leavers for the month of December 2020. They looked at the users’ mobile experience during the 30 days before they changed their mobile operator and compared that against the average experience on their original mobile network.

They found that smartphone Leavers, on average, had a worse mobile experience before they switched than the typical experience observed by other smartphone users on their original network provider. Leavers across Airtel, Jio and Vi on average spent between 74% and 155% more time without a mobile signal compared to the average scores on their networks; they also spent less time connected to either a 3G or 4G mobile connection and they experienced lower 4G Availability. Therefore, Opensignal’s data indicates that users experiencing mobile network pain points are more likely to change their mobile service provider.

Jio’s disruptive entrance into the Indian mobile market with its free data and unlimited voice calls plans initiated an undercutting strategy among the key market players. But Opensignal’s analysis of India’s mobile experience shows that having a worse mobile network experience remains a key indicator of smartphone users switching their mobile network operator. This indicates that mobile network experience is critical to understand mobile subscriber churn in India. Operators that wish to reduce churn levels in India must segment their smartphone users’ based on the quality of users’ mobile network experience.

With in cities , Airtel Network experience is superior to jio.

But under roaming ,jio is superior due to more density of sites & better coverage.

Jio is suffering in urban areas due to congestion , which may reduce or extinct from most locations after jio spectrum addition .

Open signal report is contradicting TRAI report.

As per trai report, jio has gained revenue market share of 1 % ( 38.3 % to 39.3% ) in the period (1/9/20 to 31/12/20)at the expense of all other competitors.

Airtel has gained more smart phone users in three months starting from (1/9/20 to 31/12/20) , but still Airtel has lost revenue market share by (0.3% ) .

None of the operators were able to gain revenue market share except jio.

Airtel improved port ins are not reflecting in revenues.