Spectrum is for telecommunication what jet fuel is for aviation. Spectrum is a range of electromagnetic frequencies or airwaves that telecom companies use for establishing a connection between a cell tower and a mobile phone. The bandwidth of this spectrum is directly proportional to the speed of a wireless data network (since more data can be transmitted simultaneously through a broader data pipeline). In contrast, the frequency is inversely proportional to the coverage (since lower frequencies penetrate better through physical barriers and thus have wider coverage).

The spectrum holding data sheet embedded in this article represents the current spectrum holdings of all active telecom operators across all frequency bands across all 22 telecom circles along with their liberalisation status and expiry dates. All figures represented are in MHz. The value mentioned in the bracket beside the frequency at the base of each sheet is the band number where ‘B’ stands for 4G LTE band whereas ‘n’ stands for the corresponding 5G NR band.

The spectrum shown under BSNL and Aircel in white is reserved for the respective operators but has not yet been officially allotted to them.

Spectrum Liberalisation:

Spectrum was administratively allocated to operators in each of the 22 licensed service areas or circles prior to 2010, this spectrum is called non-liberalised and can only be used for 2G services whereas all airwaves allotted post-2010 have been through a Spectrum Auction where operators have paid the market discovered price and this spectrum is called liberalised and can be used for any technology platform 2G/3G/4G/5G. Alternatively, operators may choose to liberalise their administratively allotted spectrum by paying the market-discovered price to DoT on a pro-rata basis for the remaining validity of the spectrum.

Paired and Unpaired spectrum:

Spectrum may be paired or unpaired, bands 1/3/5/8/28 are all paired where one set of frequencies is used for uplink whereas another distinct set of frequencies is used for downlink known as Frequency-division duplexing (FDD), whereas bands 40/41/78/258 are unpaired where both uplink and downlink happens in the same set of frequencies separated by the time of uplink and downlink known as Time-division duplexing (TDD).

List of Indian FDD Bands:

| 4G LTE band | 5G NR band | Uplink frequency range (MHz) | Downlink frequency range (MHz) | Bandwidth for telecom (MHz) | Block size (MHz) |

|---|---|---|---|---|---|

| B1 | n1 | 1939-1979 | 2129-2169 | 40×2 | 5×2 |

| B3 | n3 | 1710-1780 | 1805-1875 | 70×2 | 0.2×2 |

| B5 | n5 | 824-844 | 869-889 | 20×2 | 1.25×2 |

| B8 | n8 | 890-915 | 935-960 | 25×2 | 0.2×2 |

| B28 | n28 | 723-733/ 738-748 | 778-788/ 793-803 | 20×2 | 5×2 |

List of Indian TDD Bands:

| 4G LTE band | 5G NR band | Frequency range (MHz) | Bandwidth for telecom (MHz) | Block size (MHz) |

|---|---|---|---|---|

| B40 | n40 | 2300-2380 | 80 | 10 |

| B41 | n41 | 2535-2555/ 2615-2655 | 60 | 10 |

| – | n78 | 3300-3670 | 370 | 10 |

| – | n258 | 24250-27500 | 3250 | 50 |

Spectrum caps:

A spectrum cap dictates how much spectrum a particular operator can hold in a circle for a specific band. There is a 40% cap for Sub-GHz spectrum in the 700/850/900 MHz bands combined, a 40% cap for Mid-Band spectrum in the 1800/2100/2300/2500 MHz bands combined, a 40% cap for the C-Band spectrum of 3300-3670 MHz and a 40% cap for the mm-Wave spectrum bands of 24.25-27.5 GHz. The current spectrum caps are denoted in the spectrum chart.

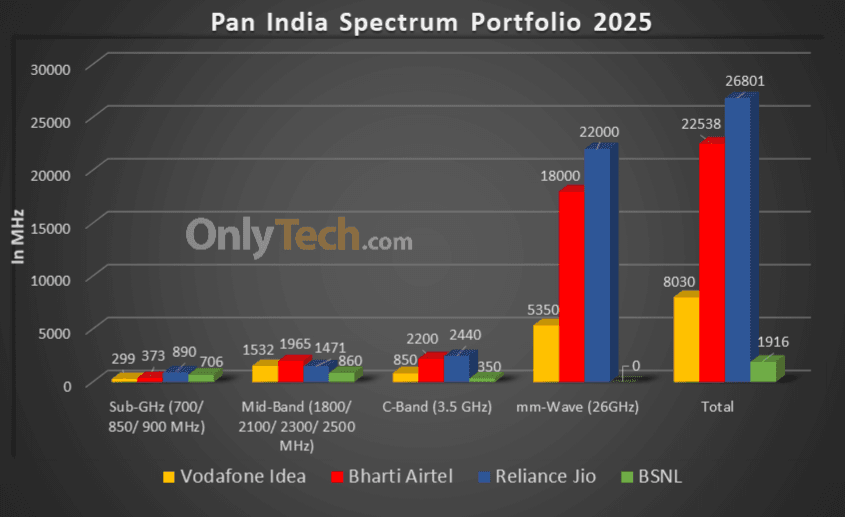

Overall spectrum holdings of operators (in MHz):

| Operator/Holding | Jio | Airtel | Vi | BSNL |

|---|---|---|---|---|

| Sub-GHz | 890 | 373.2 | 298.8 | 706 |

| Mid Band | 1470.8 | 1964.9 | 1531.6 | 860 |

| C-Band | 2440 | 2200 | 850 | 350 |

| mm-Wave Band | 22000 | 18000 | 5350 | 0 |

| Total | 26,800.8 | 22,538.1 | 8,030.4 | 1,916 |

Spectrum sharing/trading/leasing guidelines:

- Telecom operators holding CMTS/UASL/UL licenses can enter into a Spectrum-Sharing agreement with each other so long as both parties hold liberalised spectrum in the same band in the same circle. Spectrum sharing is possible only on a Pan LSA level in block sizes defined by DoT and only after one year of an operator acquiring the spectrum.

- Telecom operators holding CMTS/UASL/UL licenses can enter into a Spectrum-Trading agreement with each other so long as the spectrum being sold is liberalised. Trading of spectrum is possible only on a Pan LSA level in block sizes defined by DoT and only after two years of an operator acquiring the spectrum.

- Telecom operators may enter into a Spectrum-Leasing agreement only with Enterprises holding a Captive Non-Public Network (CNPN) license and not with each other. The lease may be limited to any geographic area within the LSA and for any duration mutually agreed upon by both parties. A CNPN licensee can lease spectrum from multiple operators within an LSA.

Note: We update this chart in real-time to ensure it is always up to date with the latest changes in spectrum holding. Certain human errors might have crept in during the manual compilation of the data, any mistakes/ rectification can be brought to the Team’s notice through the comments section below.

Is it possible for you to add information, on this page, about approximate how many 4G BTS (not 5G) does each of the telcos have pan-India? Such info will be very helpful to make informed decision & greatly appreciated. Thanks.

P.S: Can you kindly share the appx 4G BTS data of at least Jio, as Jio 4G BTS addition seems to have saturated. On Google search there are conflicting data.

I don’t have any source for that data either. DoT doesn’t release that data neither do the telcos.

Why is large amounts of spectrum still struck in the name of Rcom and Aircel even though they are non-operational? Can’t the spectrum lying with dysfunctional Rcom and Aircel in 900, 1800 and 2100 bands be auctioned? If so, what would be the procedure and timeline?

They are fully paid spectrum DOT is not giving refund on Surrender of spectrum. Other Telcos don’t want to buy high price spectrum. We have to wait till they are expired and DOT will auction it.

Ideally DoT should allow Rcom and Aircel to surrender the spectrum for a refund but these things have to go as per the terms mentioned in the notice inviting applications for the spectrum auction. For the recently concluded auction the NIA has a provision where telcos can surrender spectrum after 10 years of allotment and they don’t need to pay any more installments for the surrendered spectrum.

But for spectrum obtained in earlier auctions this clause wasn’t there, so operators have no choice but to pay DoT for it if they can’t find a buyer like an existing telco. If DoT allows them to surrender then existing telcos will cry foul and will ask DoT to let them also surrender some unwanted spectrum.

The good thing is that at least all non liberalised spectrum will expire in 2026 (mostly held by Aircel) and will be auctioned.

There is still a ray of hope that the asset management firm handling the bankruptcy and insolvency proceeding of the two telcos may be able to auction the spectrum for cheaper than current market rate and attract an existing telco as a buyer.