Spectrum is for telecommunication what jet fuel is for aviation. Spectrum is a range of electromagnetic frequencies or airwaves that telecom companies use for establishing a connection between a cell tower and a mobile phone. The bandwidth of this spectrum is directly proportional to the speed of a wireless data network (since more data can be transmitted simultaneously through a broader data pipeline). In contrast, the frequency is inversely proportional to the coverage (since lower frequencies penetrate better through physical barriers and thus have wider coverage).

The spectrum holding data sheet embedded in this article represents the current spectrum holdings of all active telecom operators across all frequency bands across all 22 telecom circles along with their liberalisation status and expiry dates. All figures represented are in MHz. The value mentioned in the bracket beside the frequency at the base of each sheet is the band number where ‘B’ stands for 4G LTE band whereas ‘n’ stands for the corresponding 5G NR band.

The spectrum shown under BSNL and Aircel in white is reserved for the respective operators but has not yet been officially allotted to them.

Spectrum Liberalisation:

Spectrum was administratively allocated to operators in each of the 22 licensed service areas or circles prior to 2010, this spectrum is called non-liberalised and can only be used for 2G services whereas all airwaves allotted post-2010 have been through a Spectrum Auction where operators have paid the market discovered price and this spectrum is called liberalised and can be used for any technology platform 2G/3G/4G/5G. Alternatively, operators may choose to liberalise their administratively allotted spectrum by paying the market-discovered price to DoT on a pro-rata basis for the remaining validity of the spectrum.

Paired and Unpaired spectrum:

Spectrum may be paired or unpaired, bands 1/3/5/8/28 are all paired where one set of frequencies is used for uplink whereas another distinct set of frequencies is used for downlink known as Frequency-division duplexing (FDD), whereas bands 40/41/78/258 are unpaired where both uplink and downlink happens in the same set of frequencies separated by the time of uplink and downlink known as Time-division duplexing (TDD).

List of Indian FDD Bands:

| 4G LTE band | 5G NR band | Uplink frequency range (MHz) | Downlink frequency range (MHz) | Bandwidth for telecom (MHz) | Block size (MHz) |

|---|---|---|---|---|---|

| B1 | n1 | 1939-1979 | 2129-2169 | 40×2 | 5×2 |

| B3 | n3 | 1710-1780 | 1805-1875 | 70×2 | 0.2×2 |

| B5 | n5 | 824-844 | 869-889 | 20×2 | 1.25×2 |

| B8 | n8 | 890-915 | 935-960 | 25×2 | 0.2×2 |

| B28 | n28 | 723-733/ 738-748 | 778-788/ 793-803 | 20×2 | 5×2 |

List of Indian TDD Bands:

| 4G LTE band | 5G NR band | Frequency range (MHz) | Bandwidth for telecom (MHz) | Block size (MHz) |

|---|---|---|---|---|

| B40 | n40 | 2300-2380 | 80 | 10 |

| B41 | n41 | 2535-2555/ 2615-2655 | 60 | 10 |

| – | n78 | 3300-3670 | 370 | 10 |

| – | n258 | 24250-27500 | 3250 | 50 |

Spectrum caps:

A spectrum cap dictates how much spectrum a particular operator can hold in a circle for a specific band. There is a 40% cap for Sub-GHz spectrum in the 700/850/900 MHz bands combined, a 40% cap for Mid-Band spectrum in the 1800/2100/2300/2500 MHz bands combined, a 40% cap for the C-Band spectrum of 3300-3670 MHz and a 40% cap for the mm-Wave spectrum bands of 24.25-27.5 GHz. The current spectrum caps are denoted in the spectrum chart.

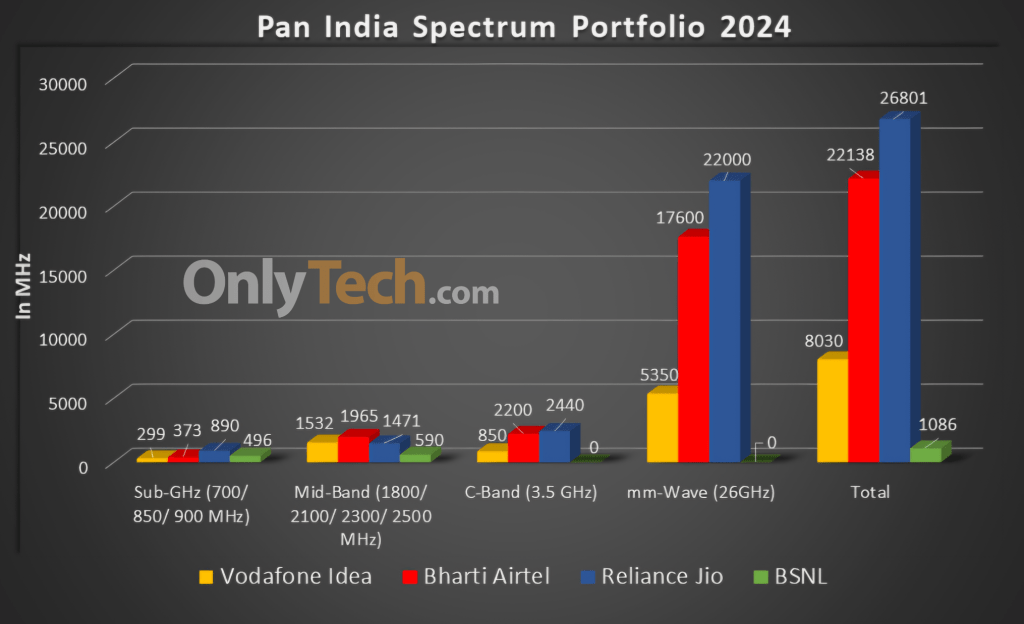

Overall spectrum holdings of operators (in MHz):

| Operator/Holding | Jio | Airtel | Vi | BSNL |

|---|---|---|---|---|

| Sub-GHz | 890 | 373.2 | 298.8 | 496 |

| Mid Band | 1470.8 | 1964.9 | 1531.6 | 590 |

| C-Band | 2440 | 2200 | 850 | 0 |

| mm-Wave Band | 22000 | 18000 | 5350 | 0 |

| Total | 26,800.8 | 22,538.1 | 8,030.4 | 1,086 |

Spectrum sharing/trading/leasing guidelines:

- Telecom operators holding CMTS/UASL/UL licenses can enter into a Spectrum-Sharing agreement with each other so long as both parties hold liberalised spectrum in the same band in the same circle. Spectrum sharing is possible only on a Pan LSA level in block sizes defined by DoT and only after one year of an operator acquiring the spectrum.

- Telecom operators holding CMTS/UASL/UL licenses can enter into a Spectrum-Trading agreement with each other so long as the spectrum being sold is liberalised. Trading of spectrum is possible only on a Pan LSA level in block sizes defined by DoT and only after two years of an operator acquiring the spectrum.

- Telecom operators may enter into a Spectrum-Leasing agreement only with Enterprises holding a Captive Non-Public Network (CNPN) license and not with each other. The lease may be limited to any geographic area within the LSA and for any duration mutually agreed upon by both parties. A CNPN licensee can lease spectrum from multiple operators within an LSA.

Note: We update this chart in real-time to ensure it is always up to date with the latest changes in spectrum holding. Certain human errors might have crept in during the manual compilation of the data, any mistakes/ rectification can be brought to the Team’s notice through the comments section below.

@Esmail Bro : Jio’s B5 (850 band) BW was always 5 mhz since beginning in UP (West). I believe RCOM’s and Jio’s B5 blocks were non-contiguous. Even before spectrum sharing agreement between RCOM and Jio ended in UP (west) Jio’s B5 was never 10 Mhz in UP (West). Now since after 2021 auctions Jio and Bharti Airtel both hold 5 mhz BW in Band 5 in UP (West). Can they deloy it as 10 mhz single block via spectrum sharing after 1 Year. Esmail bro can you please verify if Jio’s and Bharti Airtel’s Band 5 blocks in UP (West) are contiguous with each other or not ???

No, it is not exactly contiguous, There is a small guard band in between the two as you can see in the image I am sharing below

https://i.ibb.co/ngdLbrP/850-MHz-UP-west.jpg

So yes the spectrum sharing can work if DoT agrees to harmonise the holdings and remove the guard band from in between.

@Esmail Bro: Is this the current allotment scenario for B5 for UP (West) Circle ? I mean please refer the picture, the blocks alloted to RCOM are totally non-contiguous. How would RCOM utilise it as a 5 mhz carrier ? Moreover I don’t think DOT would harmonize Jio’s and Airtel’s blocks just for the purpose of spectrum sharing. Had it been Jio holding 2 blocks of 5 mhz non-contiguous carriers, then DOT would surely consider the harmonization option. Now is there any possibility of Jio making 10 mhz single contiguous B5 carrier in UP (West) circle through any option since both RCOM’s and Airtel’s spectrum is valid in B5 UP (West) for a longer period ? Also from where did you get the information as shown in this picture. The provisional results of frequency allotment to operators shared by DOT in 2021 spectrum auctions shows different frequency allotments than this to Jio and Airtel for B5 in UP (West). Please answer all the above questions.

The frequency allocated to Jio is the same as in the provisional results, Airtel’s allocation was slightly altered to ensure it gets a contiguous 5 MHz block, this is the current allocation as of today as per Saaral Sanchar wing of the Wireless Planning commission of DoT.

Yes, the allocation of Rcom is non-contiguous as most of it was originally held by MTS which had bought it in the 2013 auction for deploying it on CDMA and EvDO technology which didn’t need a contiguous 5 Mhz block, unlike 4G LTE. This spectrum was priced low by DoT since it was not intended for 4G use (even though it was liberalised) and DoT is purposely not making it contiguous so that it cant be used for 4G.

DoT has imposed a special condition on the trading of this spectrum, whereby if Rcom wants to sell it to say Jio, then it will have to pay the difference in the current market price of the 850 Mhz spectrum and that paid by MTS in 2013 to bring it at par with the other spectrum held by all operators. Only then will DoT reshuffle the blocks and make it contiguous so that Jio or another operator can use it for 4G.

@Esmail Bro: Do you think DOT would remove the guard between Jio’s and Airtel’s blocks for B5 in UP (West) to make their blocks contiguous so that they can deploy it as a single 10 mhz contiguous block ? As far as I know DOT is not obliged to do that just for the purpose of spectrum sharing since the blocks are held by 2 different operators. Am I correct or not ???

Yes they are not obligated to do that, but even if DoT doesn’t make it contiguous, Airtel and Jio can still sign a spectrum sharing pact and use it with intra band carrier aggregation B5-B5 to make a resultant 10 MHz block. And if Dot does make it contiguous through harmonization in the future then they can deploy it without the carrier aggregation as a single 10 MHz block.

@Esmail Bro: I doubt that Jio would use B5-B5 Intra-band carrier aggregation. Also there are limited devices in the market that support B5-B5 Intra-Band CA. They already have 15 mhz of Band 5 in Mumbai LSA. And as far as I know they have not deployed B5-B5 Intra-Band CA anywhere in Mumbai. Also did you find B5-B5 Intra-Band Carrier Aggregation on Jio anywhere in Mumbai ???

@Esmail Bro: Reply for this ?

I haven’t been actively monitoring that so I’m not sure whether they have deployed it here in Mumbai.

@esmail I was searching network manually. I saw Reliance 4G and also 4G. I think they are not same. If you agree then do RCOM still provide 4G or wireless service.

Yes Rcom 4G is still live in all circles where they have band 1 spectrum block of 5 MHz. They are still catering to some enterprise level customers and they still report subscriber figures to TRAI every month.