Spectrum is for telecommunication what jet fuel is for aviation. Spectrum is a range of electromagnetic frequencies or airwaves that telecom companies use for establishing a connection between a cell tower and a mobile phone. The bandwidth of this spectrum is directly proportional to the speed of a wireless data network (since more data can be transmitted simultaneously through a broader data pipeline). In contrast, the frequency is inversely proportional to the coverage (since lower frequencies penetrate better through physical barriers and thus have wider coverage).

The spectrum holding data sheet embedded in this article represents the current spectrum holdings of all active telecom operators across all frequency bands across all 22 telecom circles along with their liberalisation status and expiry dates. All figures represented are in MHz. The value mentioned in the bracket beside the frequency at the base of each sheet is the band number where ‘B’ stands for 4G LTE band whereas ‘n’ stands for the corresponding 5G NR band.

The spectrum shown under BSNL and Aircel in white is reserved for the respective operators but has not yet been officially allotted to them.

Spectrum Liberalisation:

Spectrum was administratively allocated to operators in each of the 22 licensed service areas or circles prior to 2010, this spectrum is called non-liberalised and can only be used for 2G services whereas all airwaves allotted post-2010 have been through a Spectrum Auction where operators have paid the market discovered price and this spectrum is called liberalised and can be used for any technology platform 2G/3G/4G/5G. Alternatively, operators may choose to liberalise their administratively allotted spectrum by paying the market-discovered price to DoT on a pro-rata basis for the remaining validity of the spectrum.

Paired and Unpaired spectrum:

Spectrum may be paired or unpaired, bands 1/3/5/8/28 are all paired where one set of frequencies is used for uplink whereas another distinct set of frequencies is used for downlink known as Frequency-division duplexing (FDD), whereas bands 40/41/78/258 are unpaired where both uplink and downlink happens in the same set of frequencies separated by the time of uplink and downlink known as Time-division duplexing (TDD).

List of Indian FDD Bands:

| 4G LTE band | 5G NR band | Uplink frequency range (MHz) | Downlink frequency range (MHz) | Bandwidth for telecom (MHz) | Block size (MHz) |

|---|---|---|---|---|---|

| B1 | n1 | 1939-1979 | 2129-2169 | 40×2 | 5×2 |

| B3 | n3 | 1710-1780 | 1805-1875 | 70×2 | 0.2×2 |

| B5 | n5 | 824-844 | 869-889 | 20×2 | 1.25×2 |

| B8 | n8 | 890-915 | 935-960 | 25×2 | 0.2×2 |

| B28 | n28 | 723-733/ 738-748 | 778-788/ 793-803 | 20×2 | 5×2 |

List of Indian TDD Bands:

| 4G LTE band | 5G NR band | Frequency range (MHz) | Bandwidth for telecom (MHz) | Block size (MHz) |

|---|---|---|---|---|

| B40 | n40 | 2300-2380 | 80 | 10 |

| B41 | n41 | 2535-2555/ 2615-2655 | 60 | 10 |

| – | n78 | 3300-3670 | 370 | 10 |

| – | n258 | 24250-27500 | 3250 | 50 |

Spectrum caps:

A spectrum cap dictates how much spectrum a particular operator can hold in a circle for a specific band. There is a 40% cap for Sub-GHz spectrum in the 700/850/900 MHz bands combined, a 40% cap for Mid-Band spectrum in the 1800/2100/2300/2500 MHz bands combined, a 40% cap for the C-Band spectrum of 3300-3670 MHz and a 40% cap for the mm-Wave spectrum bands of 24.25-27.5 GHz. The current spectrum caps are denoted in the spectrum chart.

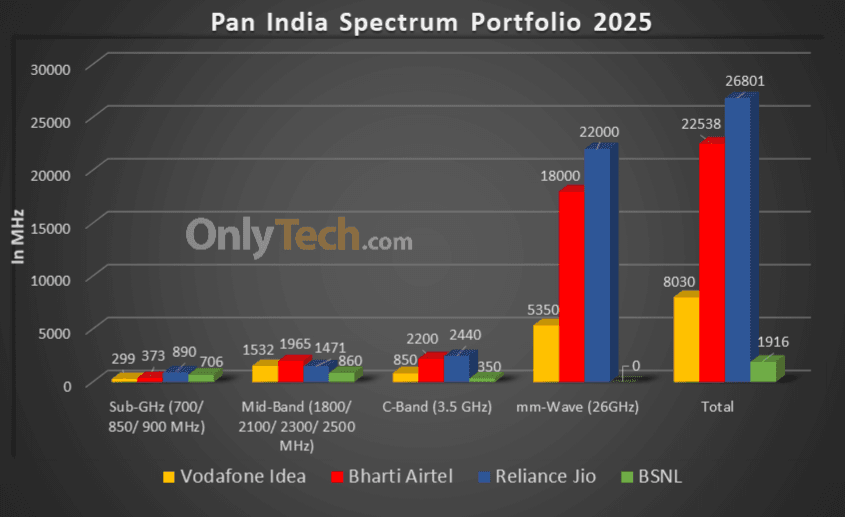

Overall spectrum holdings of operators (in MHz):

| Operator/Holding | Jio | Airtel | Vi | BSNL |

|---|---|---|---|---|

| Sub-GHz | 890 | 373.2 | 298.8 | 706 |

| Mid Band | 1470.8 | 1964.9 | 1531.6 | 860 |

| C-Band | 2440 | 2200 | 850 | 350 |

| mm-Wave Band | 22000 | 18000 | 5350 | 0 |

| Total | 26,800.8 | 22,538.1 | 8,030.4 | 1,916 |

Spectrum sharing/trading/leasing guidelines:

- Telecom operators holding CMTS/UASL/UL licenses can enter into a Spectrum-Sharing agreement with each other so long as both parties hold liberalised spectrum in the same band in the same circle. Spectrum sharing is possible only on a Pan LSA level in block sizes defined by DoT and only after one year of an operator acquiring the spectrum.

- Telecom operators holding CMTS/UASL/UL licenses can enter into a Spectrum-Trading agreement with each other so long as the spectrum being sold is liberalised. Trading of spectrum is possible only on a Pan LSA level in block sizes defined by DoT and only after two years of an operator acquiring the spectrum.

- Telecom operators may enter into a Spectrum-Leasing agreement only with Enterprises holding a Captive Non-Public Network (CNPN) license and not with each other. The lease may be limited to any geographic area within the LSA and for any duration mutually agreed upon by both parties. A CNPN licensee can lease spectrum from multiple operators within an LSA.

Note: We update this chart in real-time to ensure it is always up to date with the latest changes in spectrum holding. Certain human errors might have crept in during the manual compilation of the data, any mistakes/ rectification can be brought to the Team’s notice through the comments section below.

@esmail Do you agree with TRAI “fastest network / voice quality report ” ? I have seen them saying JIO as fastest operator and BSNL as best voice quality Operator.

The TRAI report is based on peak performance by all operators in the most ideal conditions in a month it does not take an average of performance based on multiple readings in real life usage scenarios at congestion peak hours like Open signal report does. So it’s all about the test methodology used by an agency which gives the difference in reports. I would personally recommend going by Open signal report to get the true picture.

Oo i see the same you say in a article today.

So can we say it is fake or baised to JIO because since its launch trai is the b**tlicker of jio.

@esmail why in spectrum chart vi is having 30Mhz of spectrum in Gujarat And Maharashtra Circle ? Is it a single block

I take it that you are referring to Vi’s holding in band 41 for this question. The spectrum in this band was auctioned in block sizes of 10 MHz each in the 2016 auction. The chart just shows the total holding by an operator in a band in a particular circle and not the number of blocks. Since all the spectrum was bought together in the same auction it is shown as 30 MHz in the same red colour. But if Vi is to deploy it for 4G, it can do so only through carrier aggregation using a 20 MHz and a 10 MHz chunk.

Hey @esmail, on a related topic is it possible for DoT to put the remaining spectrum (140 MHz+ per circle) on auction next year for 5G rollout?

A lot of things are possible, the government can decide to do whatever it deems in the best interest of the country so can’t predict anything in that regard.