Bharti Airtel’s Airtel Payments Banks is introducing a new product that will be offered to Bank’s savings bank account holders to protect their interest by way of 3rd factor authentication for payments via Bank’s saving bank account. The company has updated the terms and conditions listings along with the introduction of a new dedicated microsite for the new product.

The feature will only be available if your account is linked with your Airtel number and working subject to availability of an ideal network availability and server response time to trigger Airtel Safe Pay message on your registered Airtel mobile number. Bharti Airtel has claimed that it is the safest way to pay based on an internal study done on existing payment processes of major banks thereby providing various benefits to You.

Airtel Safe Pay provides an additional 3rd factor authentication which Airtel claims no other bank/wallet provides with customers set to receive one more confirmation alert on their phone for the transaction before the amount gets debited from their account. The additional layer of security works on UPI payments and Net Banking making it secure and safe.

The product makes use of superior OTA (Over the Air) technology by Airtel which is a secure network mechanism to deliver messages to you which will get delivered on your SIM directly irrespective of whether you are on call/idle etc. It uses Airtel Network Intelligence to send the alerts to your mobile number with Airtel not charging anything for responding to Safe Pay alerts.

The product will not send confirmation alerts without the physical SIM preventing major frauds which could happen due to cloning and hence your account only gets debited when you accept Airtel Safe Pay’s confirmation alert within a specific time period.

Airtel Safe Pay covers both the feature and smart phones ensuring 100% device coverage preventing you from phishing or vishing frauds, credential thefts, identity cloning, and device theft. None of your transactions will go through without your confirmation allowing zero exposure to primary account provided you use Airtel Payments bank account for your transactions.

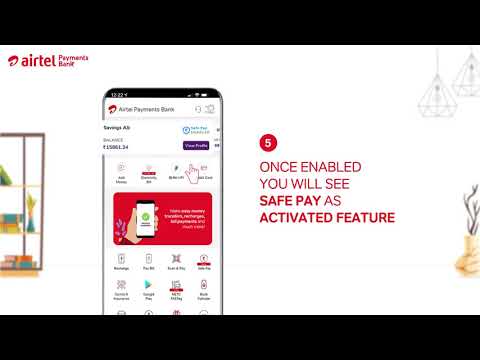

The Safe Pay feature can be enabled for your account on Airtel Thanks app post which your transactions will be subject tot 3rd factor authentication.