Bharti Airtel has managed to regain its second position with respect to the telecom subscriber market share in the month of February 2020 by overtaking Vodafone Idea, this has resulted majorly out of the uncertainty of the future of Vodafone Idea in India after the supreme court ruling in the AGR case. Airtel is now second only to Reliance Jio, with this, the pecking order of the Indian telecom industry has changed and we may be headed towards a two private operator dominated market.

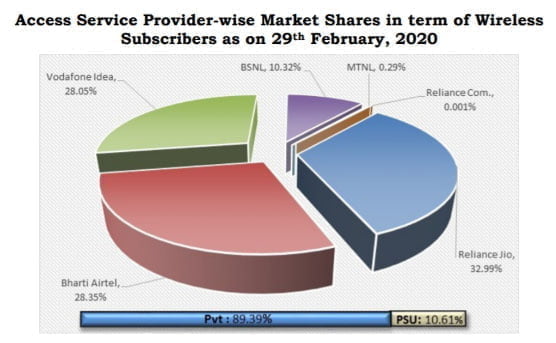

Wireless Subscriber Market share:

As of 28th February 2020 Reliance Jio is leading with 32.99% market share which translates to 382.87 million subscribers, Bharti Airtel is at second position with 28.35% market share (329.02 million subscribers), whereas Vodafone Idea comes third with 28.05% market share (325.54 million subscribers). BSNL commands 10.32% (119.77 million) while MTNL commands just 0.29% market share (3.36 million).

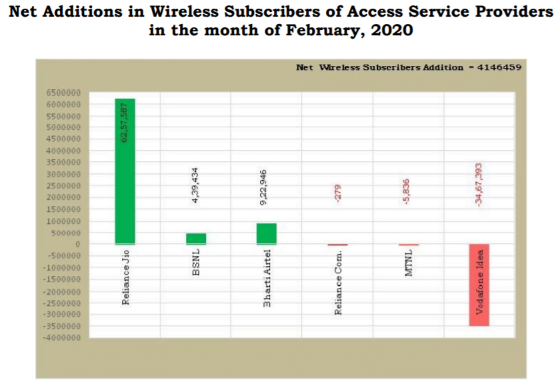

Net Subscriber Gain/Loss in February:

Jio was leading with 6.25 million new wireless subscriber additions followed by Bharti Airtel with 0.92 million and BSNL with 0.43 million additions. Vodafone Idea ended up losing over 3.46 million subscribers on account of the uncertainty of the Operator’s future in India after the Supreme court’s ruling on the AGR dues. Meanwhile, MTNL lost over 5.8 thousand subscribers in February.

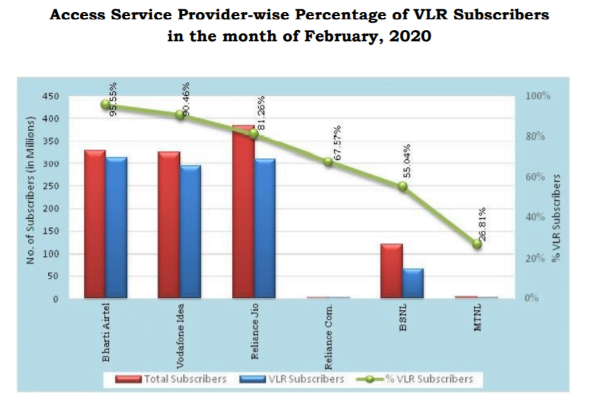

Active subscriber base, VLR data:

Visitor location register (VLR) is an indicator of what percentage of the total subscriber base is comprised of active users. Bharti Airtel leads the race in VLR numbers with over 95% of its userbase being active, it is closely followed by Vodafone Idea with over 90% userbase being active, Reliance Jio has over 81% active userbase whereas BSNL lags behind with only 55% of its total userbase being active.

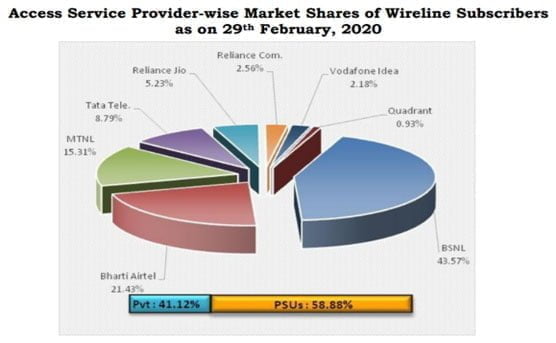

Wireline subscriber market share:

BSNL continues to lead with 43.57% share of the wireline subscriber market, even though it lost over 3.24 lakh subscribers in Feb 2020. Bharti Airtel commands 21.43% share as it added 26.2 thousand new subscribers. MTNL follows with 15.31% share, though it lost over 5.9 thousand subscribers. Reliance Jio holds 5.23% share as it added over 3.2 thousand subscribers. Vodafone Idea holds only 2.18% share as it added 4.1 thousand subscribers in Feb 2020.

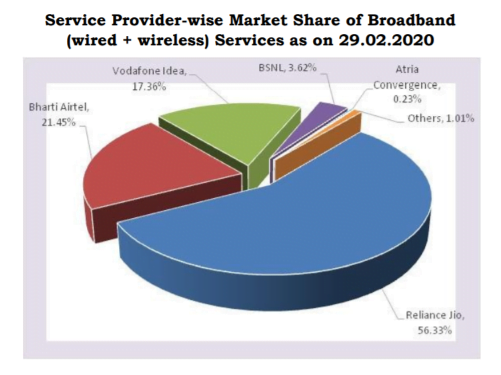

Broadband subscriber market share:

Broadband is considered when the speed offered is higher than 512 Kbps irrespective of it being a wired or wireless connection. As on 29th February 2020, the top five Wired Broadband Service providers by subscriber base were BSNL (8.11 million), Bharti Airtel (2.45 million), Atria Convergence Technologies (1.56 million), Hathway Cable & Datacom (0.94 million) and Reliance Jio Infocomm Ltd (0.84 million). The top five Wireless Broadband Service providers were Reliance Jio Infocom Ltd (382.83 million), Bharti Airtel (143.65 million), Vodafone Idea (118.23 million), BSNL (16.55 million) and MTNL (0.18 million).

Which Wireline And Broadband Service Does Vodafone-Idea Have.YOU Broadband??? Also The Main Cause Of Vodafone-Idea’s Downfall Is Its The Network Are Degrading Much And They Are Also Not Being Active In Advertising Like What Airtel Is Doing.

Yes you broadband is wholly owned by Vodafone Idea.

Do They Have Any Other Broadband Service?

No bro only you broadband but jio has so many controlling stake in different broadband providers mostly cable TV mso like Hathway, den gtpl etc.

Hmm.Right.