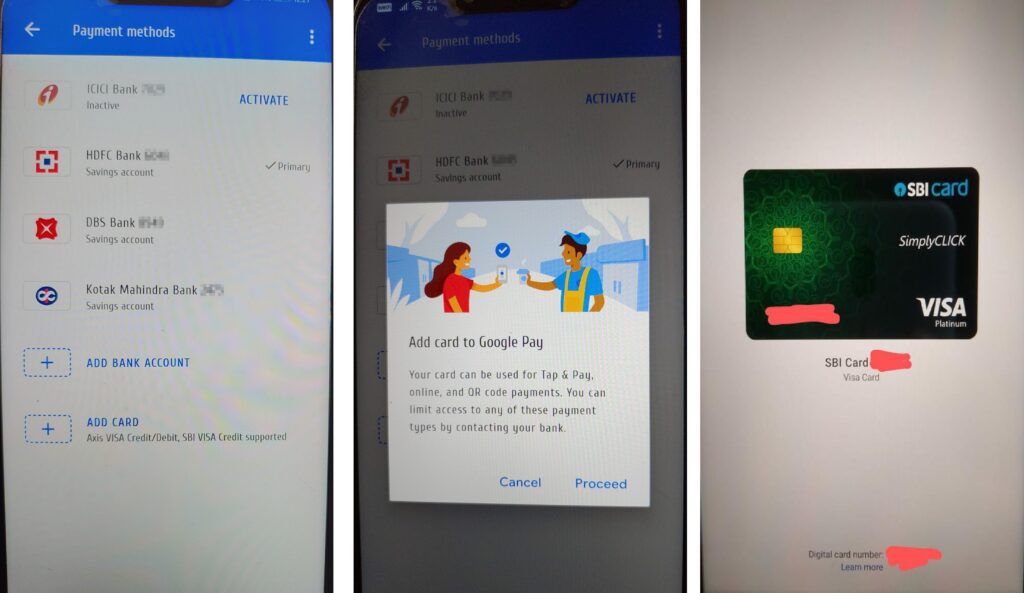

Google Pay, a popular UPI-based payments service in India, has started testing the debit and credit cards as a payment option in the country. The new payment option will enable users to pay at the NFC-enabled terminals, making contactless payments using a smartphone. The feature is currently available to a limited number of Google Pay users and supports select debit and credit cards.

Google has also published a support page that explains the steps to add debit or credit card as a payment option on Google Pay. Currently, only the Axis Bank and State Bank of India debit and credit cards are supported. While setting up the debit or credit card for the first time, the user will be asked for additional authentication via OTP received from the bank. After completing the registration process, the new payment option can be used at NFC enabled terminals, QR code-based payments at merchants, mobile recharges on Google Pay, or make online payments on 3rd party merchants where Google Pay is accepted.

When a user adds a new debit or credit card as a payment option, Google Pay creates a virtual account number, called tokens, that replaces the card details. This process is called tokenisation, and it stores the user’s personal and financial information private. A Google support page states that the tokenisation helps make sure that the user’s private information is not shared with anyone while making transactions, including transactions in other apps.

The new card-based payment feature is a server-side update, which means installing the latest Google Pay update may not enable the feature. It is currently available to a limited set of users and will be available to more users soon. Google will notify uses as and when the new payment feature is rolled out for them.

via Android Police

Google pay sucks now a days. Amount gets deducted and gets hold for few days. Then only it either gets refunded back or credited to the destination account.

Bettef use Phonepe, paytm or BHIM. Even freecharge and mobikwik are not bad.