rahul1117kumar

Member

- Joined

- 21 Jun 2013

- Messages

- 10,365

- Reaction score

- 11,058

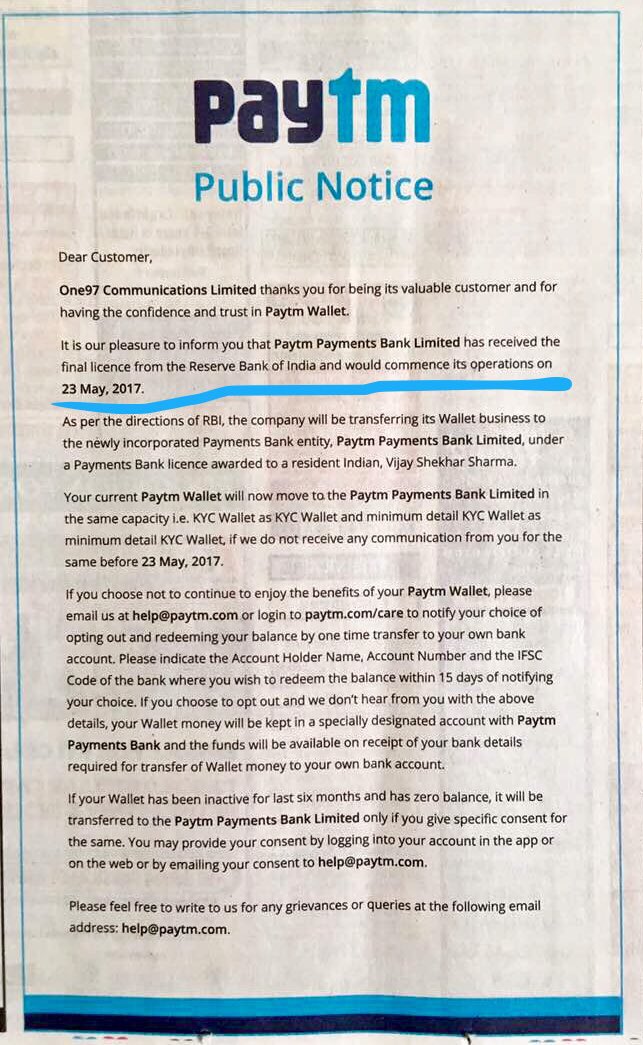

Paytm has today received the final nod from the Reserve Bank of India (RBI) to launch its payments bank services. The company, along with Airtel and nine other licensees had received an in-principle payments bank licence from RBI in August 2015. However, only Airtel has started its services so far, while Paytm had been waiting for RBI approval. Now, after getting the final approval, Paytm can now go ahead and launch its payments bank services. However, the company did not mention any specific timeline as to when the rollout is expected.

“Today, Reserve Bank of India gave permission to formally launch Paytm Payments Bank. We can’t wait to bring it in front of you,” Paytm founder Vijay Shekhar Sharma wrote on the company’s blog. He also mentioned that it was exactly three years ago when the company started its mobile wallet, and over the course of time, it has changed the way we make payments.

“At Paytm Payments Bank, our aim is to build a new business model in banking industry, focussed on bringing financial services to 100’s of millions of un-served or underserved Indians. With power of technology and innovation-at-scale, we aim to become a benchmark in world of banking,” Sharma added. He further mentioned that he will take the role of full-time executive in the Bank.

The recent demonetization of old currency notes has helped Paytm and other mobile wallet companies to register a massive surge in user base, while also increasing the number of transactions. Sharma also highlighted the fact that Paytm is now used by vegetable stalls, milk booths, small shops and retailers to accept digital money, thus moving India towards a dream of becoming cashless economy.

Last month, Paytm already mentioned that after getting the RBI nod, it will be merging its digital wallet business into its newly incorporated Paytm Payments Bank Limited (PPBL). Recently, Paytm also launched a new service that enabled merchants to accept debit and credit card payments on their smartphone without needing a card swiping PoS terminal. Earlier today Paytm also enabled the option to add money to Paytm wallet using UPI.

Paytm gets RBI nod to launch its payments bank, roll out expected soon

“Today, Reserve Bank of India gave permission to formally launch Paytm Payments Bank. We can’t wait to bring it in front of you,” Paytm founder Vijay Shekhar Sharma wrote on the company’s blog. He also mentioned that it was exactly three years ago when the company started its mobile wallet, and over the course of time, it has changed the way we make payments.

“At Paytm Payments Bank, our aim is to build a new business model in banking industry, focussed on bringing financial services to 100’s of millions of un-served or underserved Indians. With power of technology and innovation-at-scale, we aim to become a benchmark in world of banking,” Sharma added. He further mentioned that he will take the role of full-time executive in the Bank.

The recent demonetization of old currency notes has helped Paytm and other mobile wallet companies to register a massive surge in user base, while also increasing the number of transactions. Sharma also highlighted the fact that Paytm is now used by vegetable stalls, milk booths, small shops and retailers to accept digital money, thus moving India towards a dream of becoming cashless economy.

Last month, Paytm already mentioned that after getting the RBI nod, it will be merging its digital wallet business into its newly incorporated Paytm Payments Bank Limited (PPBL). Recently, Paytm also launched a new service that enabled merchants to accept debit and credit card payments on their smartphone without needing a card swiping PoS terminal. Earlier today Paytm also enabled the option to add money to Paytm wallet using UPI.

Paytm gets RBI nod to launch its payments bank, roll out expected soon