- Joined

- 20 Jul 2014

- Messages

- 7,098

- Solutions

- 4

- Reaction score

- 12,693

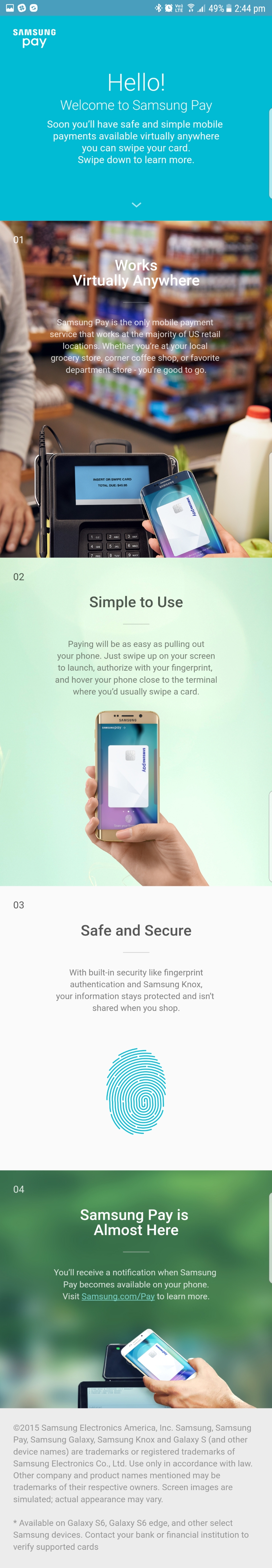

Samsung wants to expand its mobile payment service to as many markets as possible to stay ahead of the competition, and is now already teasing the launch of Samsung Pay in India.

Today, Samsung started rolling out the Android Nougat update to the Galaxy S7 and S7 edge devices. As soon as you turn on the device after it has been updated to the latest version of Android, a message pops up that says “The future of payments is coming soon!” The Nougat update also brings the Samsung Pay app to the company’s flagship devices, which is a clear sign that the payment service will soon be launched in India.

Unfortunately, we don’t have an exact time frame right now. Samsung is currently just teasing us and letting us know that we can expect the service to become available but hasn’t really shared any other specific information regarding the launch. The company will probably release more details soon.

One of the biggest advantages of Samsung Pay, when compared with rival services, is that it uses both NFC as well as Magnetic Secure Transmission (MST), which supports older magnetic credit card machines. And as the majority of card readers are compatible with MST, you’ll be able to use Samsung Pay in most shops, restaurants, and bars across the country.

As India has been going through a tumultuous demonetisation drive over the past months, interest in electronic and mobile payment systems has skyrocketed.

http://www.androidauthority.com/samsung-teasing-launch-samsung-pay-india-745375/

Today, Samsung started rolling out the Android Nougat update to the Galaxy S7 and S7 edge devices. As soon as you turn on the device after it has been updated to the latest version of Android, a message pops up that says “The future of payments is coming soon!” The Nougat update also brings the Samsung Pay app to the company’s flagship devices, which is a clear sign that the payment service will soon be launched in India.

Unfortunately, we don’t have an exact time frame right now. Samsung is currently just teasing us and letting us know that we can expect the service to become available but hasn’t really shared any other specific information regarding the launch. The company will probably release more details soon.

One of the biggest advantages of Samsung Pay, when compared with rival services, is that it uses both NFC as well as Magnetic Secure Transmission (MST), which supports older magnetic credit card machines. And as the majority of card readers are compatible with MST, you’ll be able to use Samsung Pay in most shops, restaurants, and bars across the country.

As India has been going through a tumultuous demonetisation drive over the past months, interest in electronic and mobile payment systems has skyrocketed.

http://www.androidauthority.com/samsung-teasing-launch-samsung-pay-india-745375/